By Josh Gabbatiss, Daisy Dunne, Aruna Chandrasekhar, Orla Dwyer, Molly Lempriere, Yanine Quiroz, Ayesha Tandon and Dr Giuliana Viglione

Design by Joe Goodman, Tom Pearson and Tom Prater

Every day, people are invited to buy products and services with supposed climate benefits – whether this be “carbon-neutral flights”, “net-zero beef” or “carbon-negative coffee”.

Such claims rely on “carbon offsets”. ← (Clicking links with a will display the full glossary term)

Put simply, carbon offsets involve an entity that emits greenhouse gases into the atmosphere paying for another entity to pollute less.

For example, an airline in a developed country that wants to claim it is reducing its emissions can pay for a patch of rainforest to be protected in the Amazon. This – in theory – “cancels out” some of the airline’s pollution.

It is not just businesses that are relying on carbon offsets. Major economies, too, are investing in carbon offsets as a way to meet their international emissions targets – with offsetting becoming a major talking point at UN climate negotiations.

This article is part of a week-long special series on carbon offsets.

For its supporters, offsetting is a mutually beneficial system that funnels billions of dollars into emissions-cutting projects in developing countries, such as renewable energy projects or clean cooking initiatives.

But offsetting has also faced intense scrutiny from researchers, the media and – increasingly – law courts, with businesses facing accusations of “greenwashing” over their carbon-offsetting claims.

There is mounting evidence that offset projects, from clean-cooking initiatives to forest protection schemes, have been overstating their ability to cut emissions. One yet-to-be published study suggests that just 12% of offsets being sold result in “real emissions reductions”.

Projects have also been linked to Indigenous people being forced from their land and other human rights abuses.

Decades of countries trading carbon offsets has had a negligible impact on emissions and likely even increased them.

In this in-depth Q&A, Carbon Brief explains what offsets are, how they are being used by businesses and nations, and why they can be a problematic climate solution.

The article also explores whether a system, which one expert describes as “deeply broken”, could ever be effectively reformed.

What are ‘carbon offsets’?

Carbon offsetting allows individuals, businesses or governments to compensate for their emissions, by supporting projects that reduce emissions elsewhere.

In theory, after cutting their emissions as much as possible, offsets can pay for low-carbon technologies or forest restoration to “cancel out” emissions they cannot avoid.

This could also provide support for relatively low-cost climate action in developing countries and facilitate greater global ambition.

But, in practice, offsetting often enables these entities to justify “business as usual” – producing the same volume of emissions while making claims of reductions that rely on offsets.

Carbon offsets are tokens representing greenhouse gases “avoided”, “reduced” or “removed” that can be traded between an entity that continues to emit and an entity that reduces its own emissions or removes carbon dioxide (CO2) from the atmosphere.

While it allows the first group to continue to emit, theoretically, the second must reduce its emissions or sequester CO2 by an equivalent amount.

Offsets are usually calculated as a tonne of CO2-equivalent (tCO2e) and are also described as tradable “rights” or certificates.

The terms “carbon offsets” and “carbon credits” are often used interchangeably, but the key difference lies in the marketplace they are traded in and how they are mandated to deliver on emissions reductions.

There are broadly two types of carbon markets on which offsets can be traded. The first is the “compliance” market, which is regulated and involves emissions reductions that are mandated by law, supported by common standards and count towards national or sub-national targets.

Common examples include cap-and-trade emissions trading schemes, such as the EU Emissions Trading System (ETS), where power plants and factories must submit carbon “allowances” to cover their emissions each year, within an overall “cap” for regulated sectors.

Companies can buy and sell allowances from – and to – each other. In some cases they can also buy approved offsets from external emission-cutting projects to stay within their limits.

Sign-up to Carbon Brief’s award-winning newsletters here

Such schemes cover around 18% of global emissions and, according to the Intergovernmental Panel on Climate Change (IPCC), they have contributed to emissions cuts in the EU, US and China.

Nevertheless, there is considerable evidence that many of the external offsets that have fed into these schemes have resulted in negligible emissions cuts. (See: How are countries using carbon offsets to meet their climate targets?)

The second type of carbon market is the largely unregulated voluntary carbon market, where offsets are used by corporations, individuals and organisations that are under no legal obligation to make emission cuts. Here, there is far less oversight and even less evidence of real-world emissions reductions.

(Most available credits are eligible for use on the voluntary market, but only a smaller subset can be used for compliance. Initially, UN and government-backed programmes were for compliance markets and NGO-backed programmes were for the voluntary market, but both types of programme now often cater to both markets.)

The table below shows a sample of offsetting registries and programmes on offer. These bodies “issue” offsets – meaning they confirm that a number of tonnes of CO2 has been cut, avoided or removed by a project.

These credits are then bought and “retired” when an entity wishes to count them towards its voluntary goal or binding emissions target. Once retired, they cannot be used again.

| Offset programme | Organisation | Organisation type | Project location | Credit name | Credits issued (equivalent to tonnes of CO2) |

|---|---|---|---|---|---|

| Clean Development Mechanism (CDM) | UN | UN | Developing countries | Certified Emission Reduction (CER) | 2,339,601,424 |

| Article 6.4 | UN | UN | International | A6.4ERs | 0 |

| Verified Carbon Standard (VCS) | Verra | NGO | International | Verified Carbon Unit (VCU) | 1,155,861,119 |

| Gold Standard (GS) | Gold Standard Foundation | NGO | International | Verified Emission Reduction (VER) | 257,086,982 |

| American Carbon Registry (ACR) | Winrock International | NGO | Mainly US | Emission Reduction Tonne (ERT) | 94,388,698 |

| Climate Action Reserve (CAR) | Climate Action Reserve | NGO | US, Canada and Mexico | Climate Reserve Tonne (CRT) | 74,984,609 |

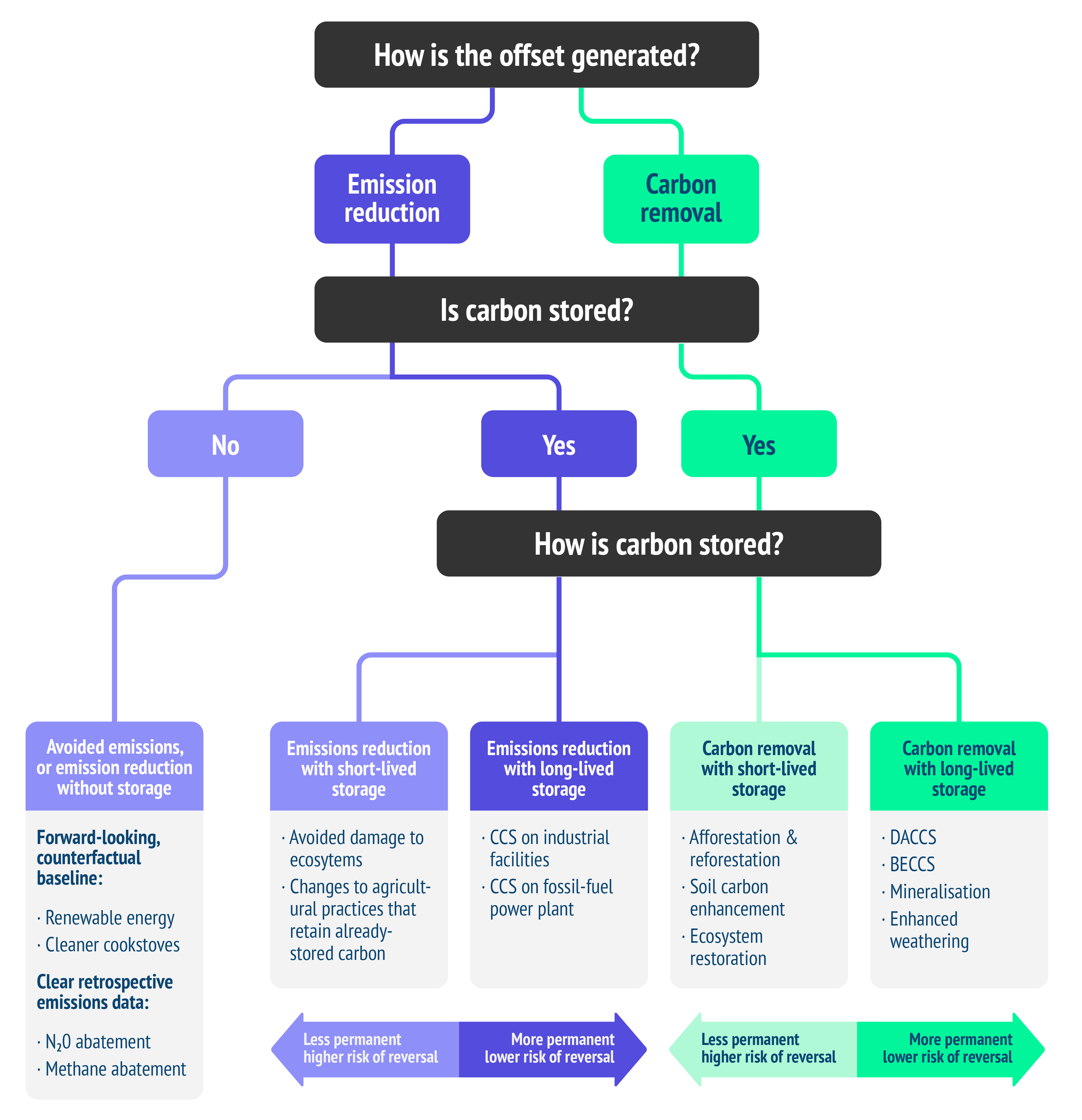

Offsets can broadly be sorted into two groups, which can be seen in the flow chart below, based on the work of the Oxford Offsetting Principles – an academic framework that seeks to define “best practice” for offsetting.

The first group covers “emissions reductions”. These offsets are used when an entity attempts to compensate for an increase in emissions in one area by decreasing emissions in another area. This group of offsets spans a few types, depending on whether emissions are avoided or reduced, with or without storage.

“Avoidance” or “avoided emissions” offsets are from projects that represent emissions reductions compared to a hypothetical alternative. One of the main types of avoidance offsets is renewable projects that are built instead of fossil-fuel plants. Another is “clean” cookstove schemes, where the distribution of more efficient cooking equipment is intended to cut reliance on traditional fuels, such as firewood, leading to lower emissions.

(Note that carbon offsets are a minefield of overlapping terminology and definitions. Here, “avoided emissions” offsets, as defined by the Oxford Offsetting Principles, are distinct from “emissions avoidance” credits, which have a distinct meaning within UN climate talks.)

Emission reduction offsets with short-lived storage of the relevant CO2 include credits from avoided deforestation projects, such as under the framework for reducing emissions from deforestation and forest degradation (REDD+). These are projects that aim to avoid emissions by protecting forests that would have otherwise been cleared or degraded.

(REDD+ was developed at the UN in the late 2000s as a way to help developing countries preserve their forests and is part of the Paris Agreement on climate change. Separately, projects labelled as REDD+ – which may not be aligned with UN rules – have emerged as a major part of the voluntary offset market, accounting for around a quarter of total volumes.)

Adding carbon capture and storage (CCS) technology to a fossil-fuel power plant, meanwhile, could generate emission reduction credits with a longer shelf-life.

“Removals” offsets are generated by projects that absorb CO2 from the atmosphere. Today, most removal offsets involve tree-planting projects, which do not guarantee permanent storage. (See: Could carbon-offset projects be put at risk by climate change?)

A new wave of more permanent removal offsets could be generated using machines that suck CO2 out of the air and techniques such as enhanced rock weathering. So far, these offsets are limited to the voluntary market and are still under review for inclusion in a new international “Article 6” carbon market by the UN.

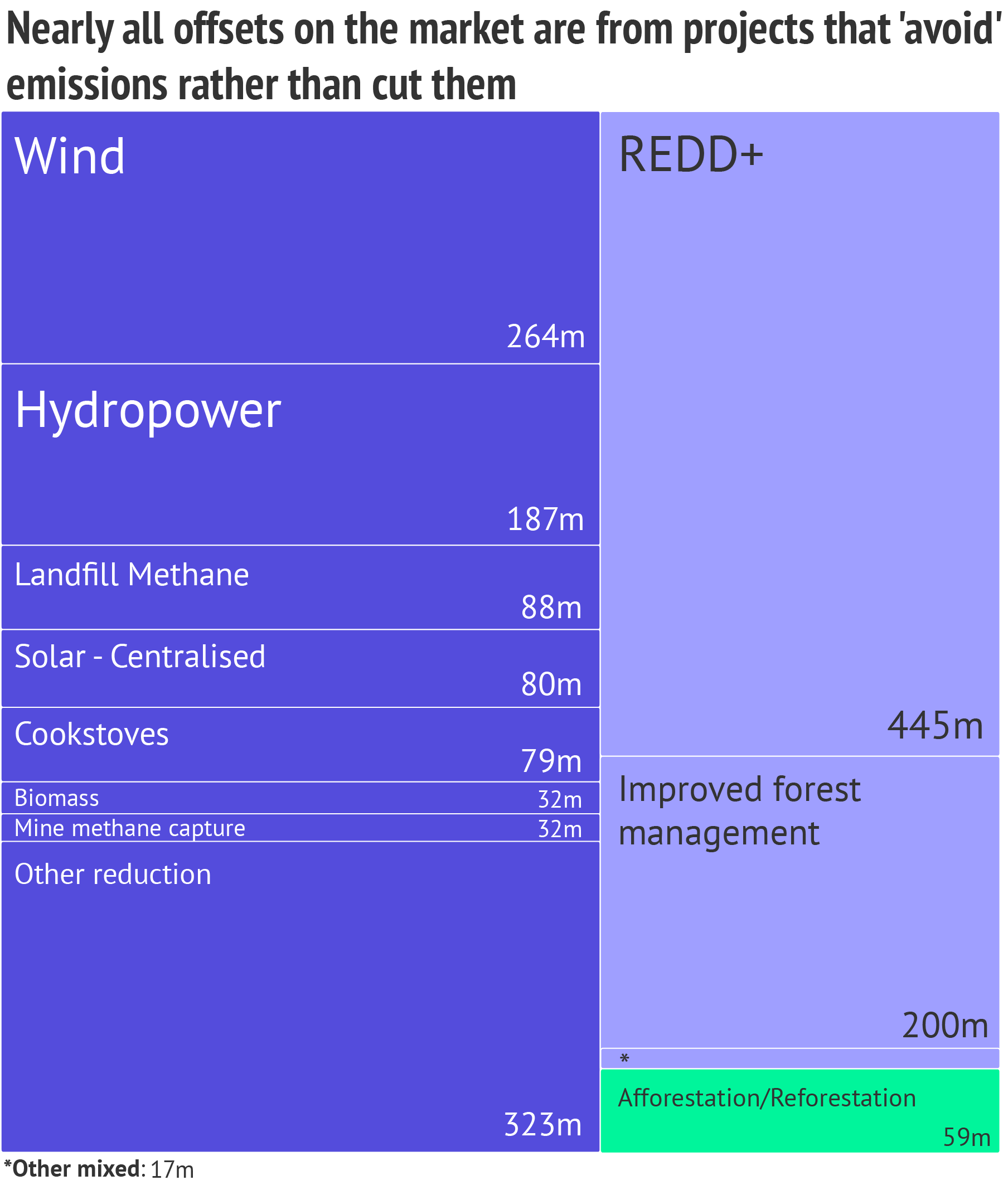

According to Carbon Brief analysis of data from the Berkeley Carbon Trading Project, just 3% of offsets on the four largest voluntary offset registries involve removing CO2 – all from tree-planting projects.

Many available offsets have been labelled “junk” or “hot air” because they result from carbon-market design flaws and do not represent real emissions reductions.

The ideas and experiments with carbon offsets and trading trace back at least half a century, as outlined in the timeline below.

Timeline: The 60-year history of carbon offsets

Tracing the origins, ideas, arguments, milestones and controversies, from the 1960s through to today.

Over the years, offset projects have been dogged by allegations of land conflicts, human rights abuses, hampering conservation and furthering coal use and pollution.

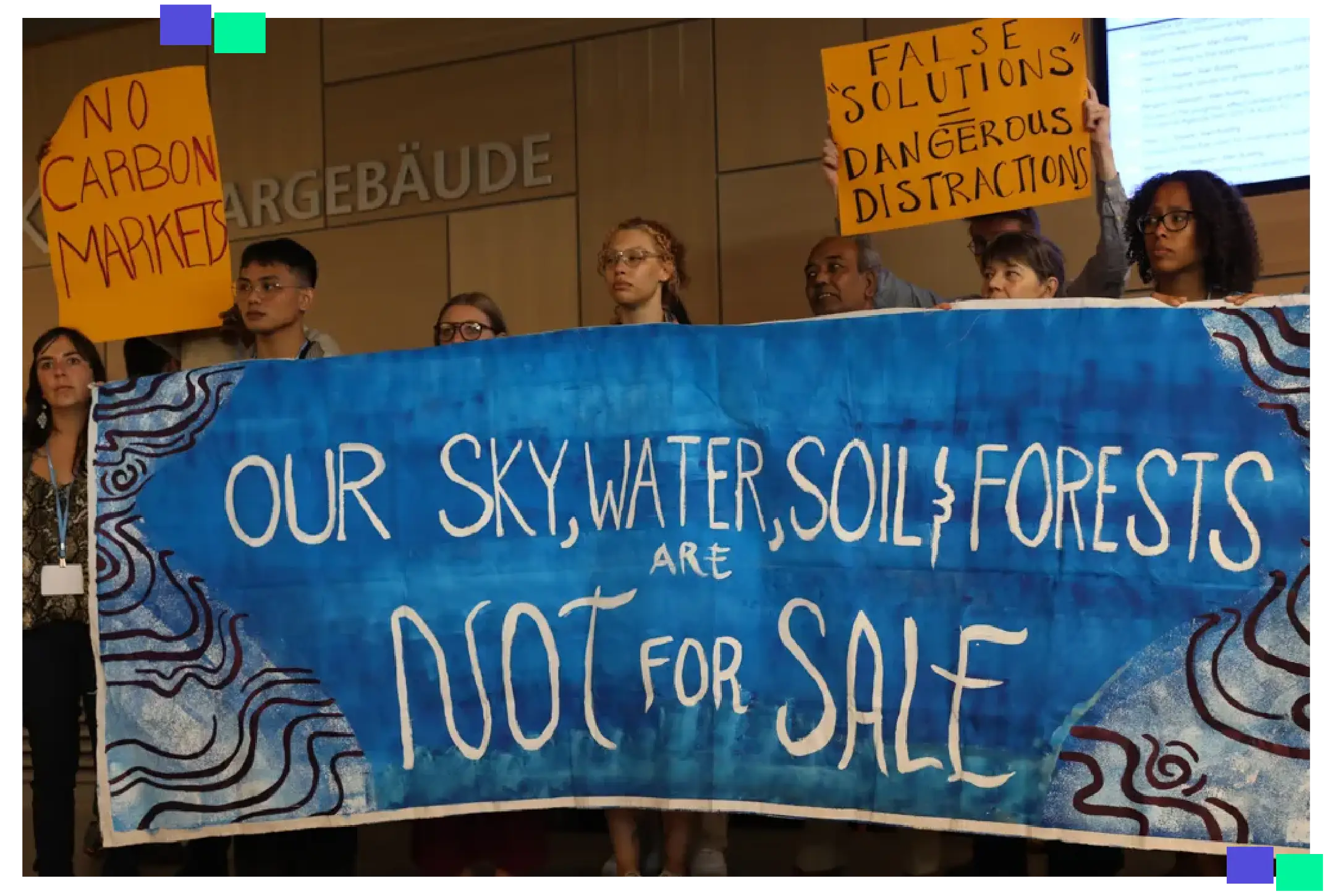

They have been decried as a “false solution” by activists. Negotiations over new carbon markets under Article 6 of the Paris Agreement have seen a sustained outcry for not delivering mitigation at scale, threatening Indigenous rights and “carbon colonialism”.

Meanwhile, companies claiming carbon neutrality using voluntary offsets have been increasingly called out and restrained from making “greenwashing” claims. (See: Why is there a risk of greenwashing with carbon offsets?)

The central problem of carbon offsetting is summarised by Robert Mendelsohn, a forest policy and economics professor at Yale School of the Environment. Reflecting on the achievements of carbon offsets, he tells Carbon Brief:

“They have not changed behaviour and so they have not led to any reduction of carbon in the atmosphere…They have achieved zero mitigation.”

Yet with carbon offsets now firmly established, there are still many who view them as an effective way to bolster corporate climate action, encourage governments to pledge more ambitious emissions cuts and channel climate finance where it is most needed.

“I think we can solve the problems that we currently have in the carbon-market space,” Bogolo Kenewendo, a member of the steering committee for the Africa Carbon Markets Initiative, tells Carbon Brief, emphasising the need for “high quality and high integrity credits”.

What does science say about the need for carbon offsets?

Since its formation in 1988, the UN’s climate science authority, the Intergovernmental Panel on Climate Change (IPCC), has published six sets of “assessment reports”. These documents summarise the latest scientific evidence about human-caused climate change and are considered the most authoritative reports on the subject.

Prof Joeri Rogelj – director of research at the Grantham Institute – Climate Change and the Environment and professor in climate science and policy at the Centre for Environmental Policy at Imperial College London – has been involved in writing several of these reports.

He tells Carbon Brief that the phrase “carbon offsets” is “not part of the jargon that the [scientific] literature uses”, so it is not widely used in IPCC reports either.

Most carbon-offset projects around today involve “emissions reductions”, whereby an entity can compensate for their pollution by paying for emissions to not happen somewhere else.

This is most commonly achieved by entities supporting, say, the creation of new renewable energy projects in the place of fossil-fuel schemes, for projects that supply clean cookstoves in the global south or for projects that protect ecosystems in order to avoid more deforestation. (More on this in: What are ‘carbon offsets’?)

While IPCC reports do not say much on carbon offsets, they do discuss the role that these kinds of techniques could play in helping the world meet its climate goals.

For example, the latest IPCC report on how to tackle climate change says that all scenarios for limiting global warming to either 1.5C or 2C involve “greatly reduced” fossil fuel use and a transition to low-carbon sources of energy, such as renewables.

It also says that changes to land-use, such as stopping deforestation, “can deliver large-scale greenhouse gas emissions reductions” – although it adds that this “cannot fully compensate for delayed action in other sectors”.

The report also notes that all scenarios for keeping global warming at 1.5C or 2C require “widespread” access to clean cooking.

A much smaller proportion of carbon offsets around today work by aiming to remove CO2 from the atmosphere to compensate for an entity’s emissions elsewhere.

This is commonly achieved by planting trees, which remove CO2 from the atmosphere as they grow, or by restoring damaged ecosystems, which are natural carbon stores.

Other, more technologically advanced types of CO2 removal are being tested and developed by a handful of companies around the world.

These include growing plants, burning them to generate energy and then capturing the resulting CO2 emissions before they reach the atmosphere – a technique called bioenergy with carbon capture and storage (BECCS).

Another proposed technique would be to use giant fans to suck CO2 straight from the atmosphere before burying it underground or under the sea – a technology called direct air capture and storage (DACCS).

However, neither one of these technologies exist at scale at present – and, therefore, do not yet play a large role in carbon offsetting.

The latest IPCC report on how to tackle climate change concludes that CO2 removal techniques are now “unavoidable” if the world is to limit global warming to 1.5C or 2C.

And Carbon Brief analysis finds that CO2 removal is used to some extent in nearly all scenarios that limit warming to below 2C.

While there is clear scientific evidence that techniques to cut emissions and remove CO2 from the atmosphere will be needed to meet global climate goals, there is not yet a clear understanding of whether finance provided via carbon offsets could – or should – help with implementation.

The latest IPCC report on how to tackle climate change does not discuss in detail the extent to which carbon-offset finance provided by countries could help with implementation, report lead author Dr Annette Cowie, principal climate scientist at the University of New England in Australia, tells Carbon Brief.

One reason for this is that the report was written when countries were still debating the rules for how carbon markets should work under the Paris Agreement, Cowie says. (For more, see: How are countries using carbon offsets to meet their climate targets?)

In addition, the report did not have a “a big focus” on how businesses and organisations use carbon offsets in the voluntary carbon market because the IPCC tends not to focus on the “company level”, she says. (For more, see: How are businesses and organisations using carbon offsets?)

Nevertheless, the report does say that “we will need the private sector to contribute to funding the climate challenge” and refers to carbon markets as a “potentially effective mechanism to achieve this”, she adds.

How are countries using carbon offsets to meet their climate targets?

Nearly every country in the world has set out plans under the Paris Agreement to cut its emissions. Most major economies also have net-zero targets.

Nations have also agreed on a succession of carbon-offset programmes, overseen by the UN. These systems could, in theory, help identify the cheapest emission cuts and enable those countries struggling with their climate goals to pay for reductions elsewhere.

This could help governments achieve their targets and encourage them to set more ambitious ones. It could also deliver money to developing countries, where much of the low-hanging fruit is located – but financial support is needed to take advantage of it.

Yet, despite being in operation for around two decades, so far these mechanisms have not driven a tangible reduction in countries’ emissions.

Instead, energy companies and factories in large, emerging economies have made money selling cheap, but often worthless, offsets to developed countries. As a result, these programmes have increased global emissions.

The earliest major offset schemes were established with the Kyoto Protocol – the first binding international agreement to cut emissions – in 1997.

By far the largest was the Clean Development Mechanism (CDM). This is a compliance mechanism that has allowed developed countries to meet their binding Kyoto emissions targets by buying credits largely generated by low-carbon energy projects in developing countries.

Souparna Lahiri, climate policy advisor with the Global Forest Coalition and a critic of carbon markets, tells Carbon Brief the CDM gave “leeway” to developed countries:

“[They said] let’s spend money where you can reduce [emissions] at a much cheaper cost. So we don’t spend much, but in return for investing…we get a credit that we can balance out with our own emissions.”

The CDM was also meant to channel much-needed climate finance to developing nations, which were not obliged to cut their own emissions under the Kyoto Protocol.

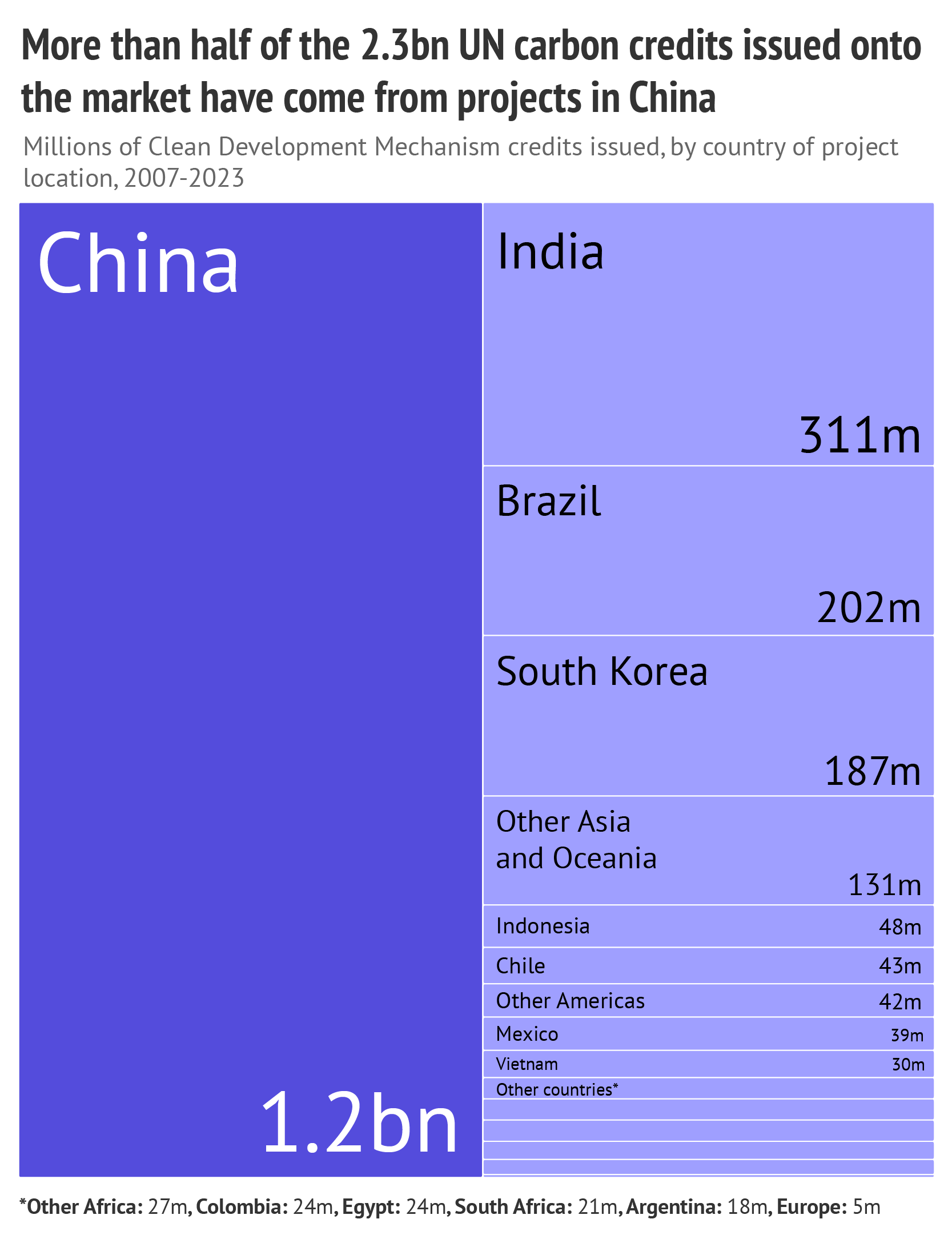

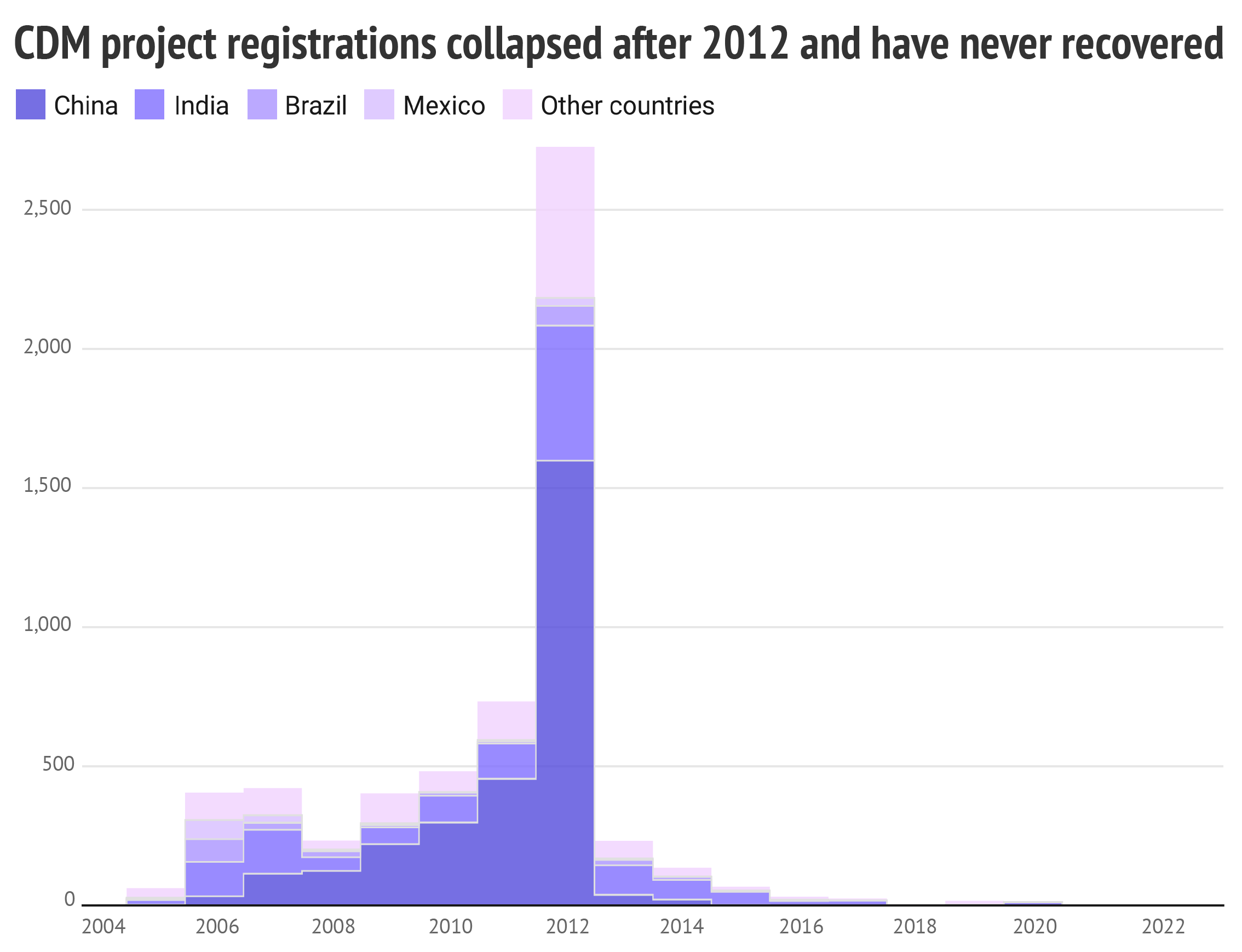

Carbon Brief analysis of UNFCCC data shows China, India, South Korea and Brazil account for 81% of the CDM credits that have been issued, with China alone issuing more than half, as the chart below shows. Barring Egypt and South Africa, African nations have issued just 1% of the credits on the market.

The CDM was agreed alongside another offsetting strategy, termed “Joint Implementation”, which covered trading in offsets between developed countries.

The EU, New Zealand and Switzerland allowed their power plants and factories to purchase Kyoto credits to meet their emissions trading system (ETS) targets, providing the main market for these offsets. Roughly half of the 2.3bn credits issued by the CDM have been used in the EU ETS.

(As of 2020, CDM credits were no longer eligible for use under the EU ETS.)

According to one study, the Kyoto markets helped nine developed countries, including Japan, Spain and Switzerland, meet their initial targets.

Despite this apparent success, many have concluded that the CDM has, ultimately, hindered rather than helped global climate action.

This is because most of the low-carbon projects it supported would likely have happened without finance from developed countries, either because they were already profitable or required by law.

A 2016 EU-commissioned study concluded that 85% of CDM projects, particularly wind power and hydropower plants, were likely to have overestimated their emissions reductions and supported no “additional” low-carbon capacity in developing countries. According to the IPCC’s AR6 report:

“There are numerous findings that the CDM, especially at first, failed to lead to additional emissions cuts in host countries, meaning that the overall effect of CDM projects was to raise global emissions.”

One study found the CDM may have increased emissions by 6bn tonnes of CO2 (GtCO2).

Reports began to emerge in 2012 that the CDM market had “collapsed” amid a “carbon panic”. This was largely the result of a lack of demand from the EU ETS.

From 2012, the EU decided to limit the credits it would accept under the scheme – for example, excluding those generated by industrial gas cuts in factories. Such CDM projects had been accused of incentivising the additional production of greenhouse gases in order to claim credits for destroying them.

The EU also stopped accepting new credits unless they came from least developed countries. At the same time, other developed countries failed to set more ambitious Kyoto targets, meaning there was little demand from outside the EU.

(Despite pushing hard for the inclusion of carbon offsetting, the US ended up not participating in the Kyoto Protocol at all, removing a key potential market for credits.)

The credit price slumped from a record high of $27.50 per tonne of CO2 in 2008 to $0.55 per tonne in 2012. As the chart below shows, the number of new projects being registered to participate in the CDM fell dramatically and has never recovered (although projects continue to issue credits to this day).

Source: UNFCCC. Chart: Carbon Brief.

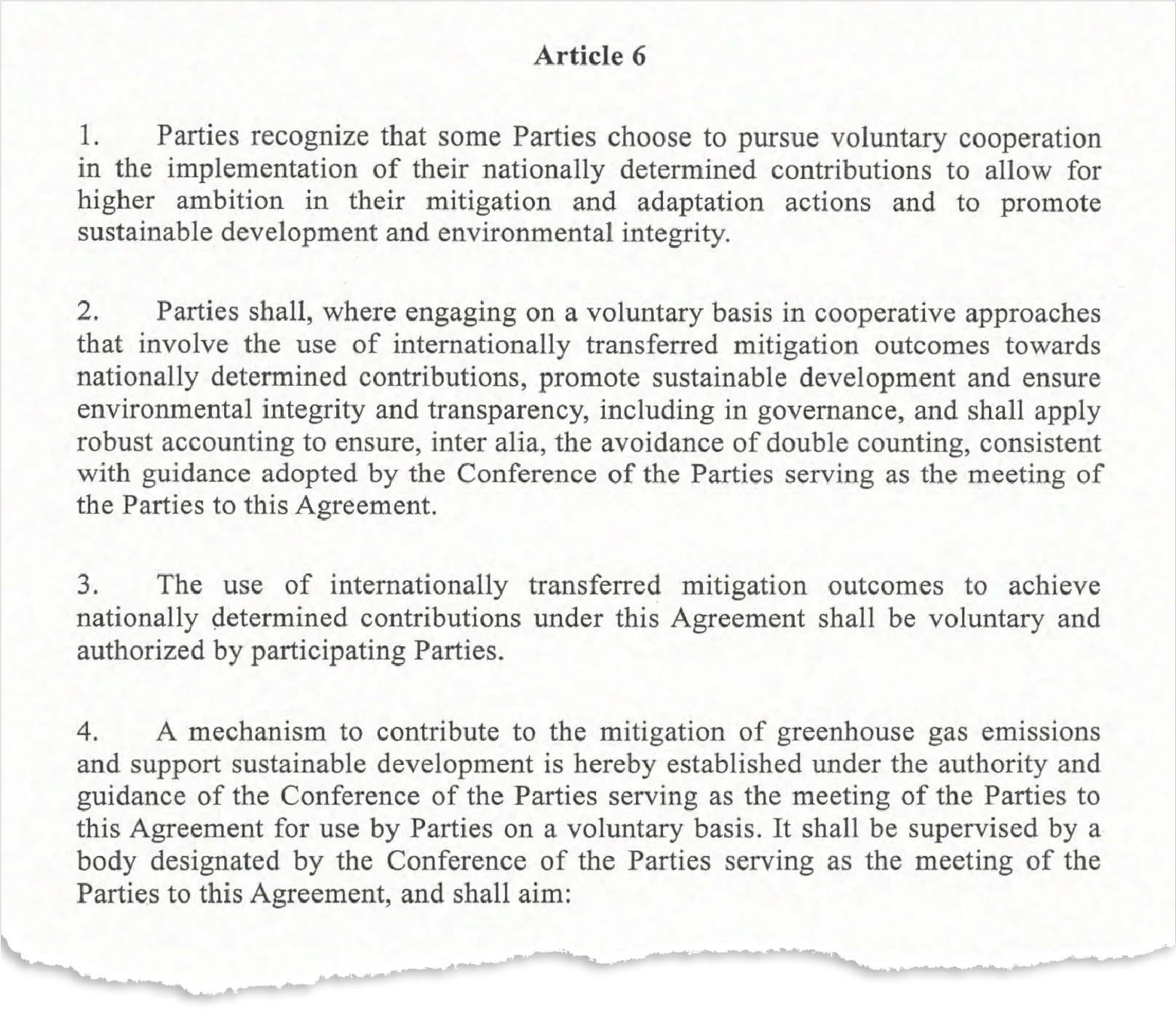

With the Paris Agreement, countries agreed to establish new carbon markets that would ultimately replace the troubled Kyoto system. They are collectively known as Article 6 markets, referring to the section of the treaty laying out how countries could “pursue voluntary cooperation” to reach their climate targets.

The carbon-trading components include Article 6.2, which enables countries to directly trade credits dubbed Internationally Transferred Mitigation Outcomes (ITMOs) with each other, and Article 6.4, which creates a new, UN-backed carbon market to effectively replace the CDM.

Unlike the CDM, any country – developed or developing – can buy and sell credits using Article 6 mechanisms to meet their climate goals under the Paris Agreement.

Critically, the new carbon market established under Article 6.4 – but not Article 6.2 – includes a specific goal to “deliver an overall mitigation in global emissions”, achieved by automatically cancelling 2% of any credits that are traded in this system.

This should mean that offsetting under this system is no longer a zero-sum game. No one will be allowed to use those 2% of credits to claim an emissions reduction, ensuring a real-world drop rather than simply moving emissions cuts from one place to another.

Nations have also agreed to avoid “double-counting” Article 6 credits, meaning that if an offset is sold by one country to another, they cannot both count its emissions cuts towards their climate targets. (See: Why is there a ‘double-counting’ risk with carbon offsets?)

Negotiations over the technical details of these new markets have been lengthy and complex.

Some details are still being hashed out by an Article 6.4 supervisory body and the trade in credits under this system is not expected to start until 2024 at the earliest, once the final rules have been established.

Among the issues at stake in the body’s various meetings are methodologies for calculating how many credits are issued and whether to include carbon-removal projects.

Some initial agreements to exchange ITMOs under Article 6.2 have already been made between a handful of nations, including Switzerland with Peru and Ghana.

(See Carbon Brief’s in-depth explainer on the background and technical elements of Article 6 carbon markets, plus the overviews of COP25, COP26, COP27 and the most recent UN talks in Bonn, for details of how these markets have been negotiated.)

According to the International Emissions Trading Association (IETA), 156 countries have signalled their intention to use Article 6 markets either as buyers or sellers. It estimates that the markets could trigger billions of dollars in climate investment and reduce the total cost of implementing climate plans by $250bn a year by 2030.

(IETA represents the carbon-trading sector, including fossil-fuel companies, which have broadly supported market-based approaches in UN climate negotiations.)

Pedro Chaves Venzon, international policy advisor at IETA, tells Carbon Brief:

“I expect rapid growth of engagement with Article 6 in the coming years…because not all countries have the potential to scale emission reductions and removals to achieve net-zero only through domestic action.”

Yet supply and demand for Article 6 credits is not guaranteed.

Unlike the Kyoto Protocol, the Paris Agreement requires every country to make an emissions-cutting pledge, not just developed countries.

The avoidance of double-counting could, therefore, make it difficult for countries to both sell large numbers of offsets and also meet their emissions goals. Scott Vaughan, senior fellow at the International Institute for Sustainable Development (IISD), tells Carbon Brief.

“It’s really important for sellers to beware, particularly for developing countries, because you don’t want to be in a position where you end up essentially selling your low-hanging fruit… [then having] very few options in terms of your own domestic [goals].”

Moreover, IETA’s assumptions about nations buying and selling credits are based on governments having more ambitious plans to cut emissions than they do today. If climate goals are not ramped up, there will be less pressure to buy emissions offsets from others.

Finally, civil society groups are concerned that Article 6 markets could repeat the same mistakes as the CDM.

Following years of argument, a relatively small number of CDM credits issued during 2013-2020 are eligible for use to meet nations’ 2030 climate pledges under the Paris Agreement.

(Australia had long proposed to use such credits to meet its Paris pledge. In 2020, following years of pressure, it climbed down and agreed to meet its pledge through domestic action.)

In addition, CDM projects will be allowed to continue issuing credits under the new system, if they meet the new Article 6.4 rules. This could lead to billions of what Carbon Market Watch calls “largely dud credits” entering the Paris regime, with one analysis estimating that up to 2.8bn carbon credits could be issued.

How are businesses and organisations using carbon offsets?

Businesses and other organisations are turning to carbon offsets in response to growing pressure to act on climate change, either to meet legal targets or their own, self-assigned emissions goals.

More than half of the world’s largest 100 companies by revenue have said they intend to purchase offsets, according to Carbon Brief analysis of Net Zero Tracker data. Only four have expressly ruled them out – Walmart, Brookfield Asset Management, Roche and Thai oil-and-gas company PTT Exploration & Production.

Among the biggest offset users are large oil-and-gas companies, airlines and car manufacturers.

In theory, “best practice” for businesses using offsets would involve them cutting their emissions as much as possible each year. Then, offsets could be purchased from elsewhere to cover any “residual” emissions that are too difficult or costly to reduce.

Yet there have been many accusations of “greenwashing” as firms buy cheap offsets of questionable quality, often from projects in developing countries, rather than doing their best to cut their own emissions. (See: Why is there a risk of greenwashing with carbon offsets?)

In places such as the EU, California and Quebec, high-emitting businesses, including factories and power plants, can purchase compliance offsets to meet their legal emissions-cutting obligations under regional emissions trading schemes. These schemes cover billions of tonnes of emissions – and some have linked emissions cuts at participating facilities to the impact of the regulations.

The UN Carbon Offsetting and Reduction Scheme for International Aviation (Corsia) is a unique example where an entire sector will be obliged to purchase carbon credits to offset its emissions growth beyond 2027.

Beyond such legal requirements, businesses have faced growing societal demand for climate action, corporate social responsibility and the uptake of net-zero pledges.

An entire market has sprung up to serve this demand, known as the voluntary offset market. It is largely unregulated and frequently described as a “wild west” full of “junk” credits.

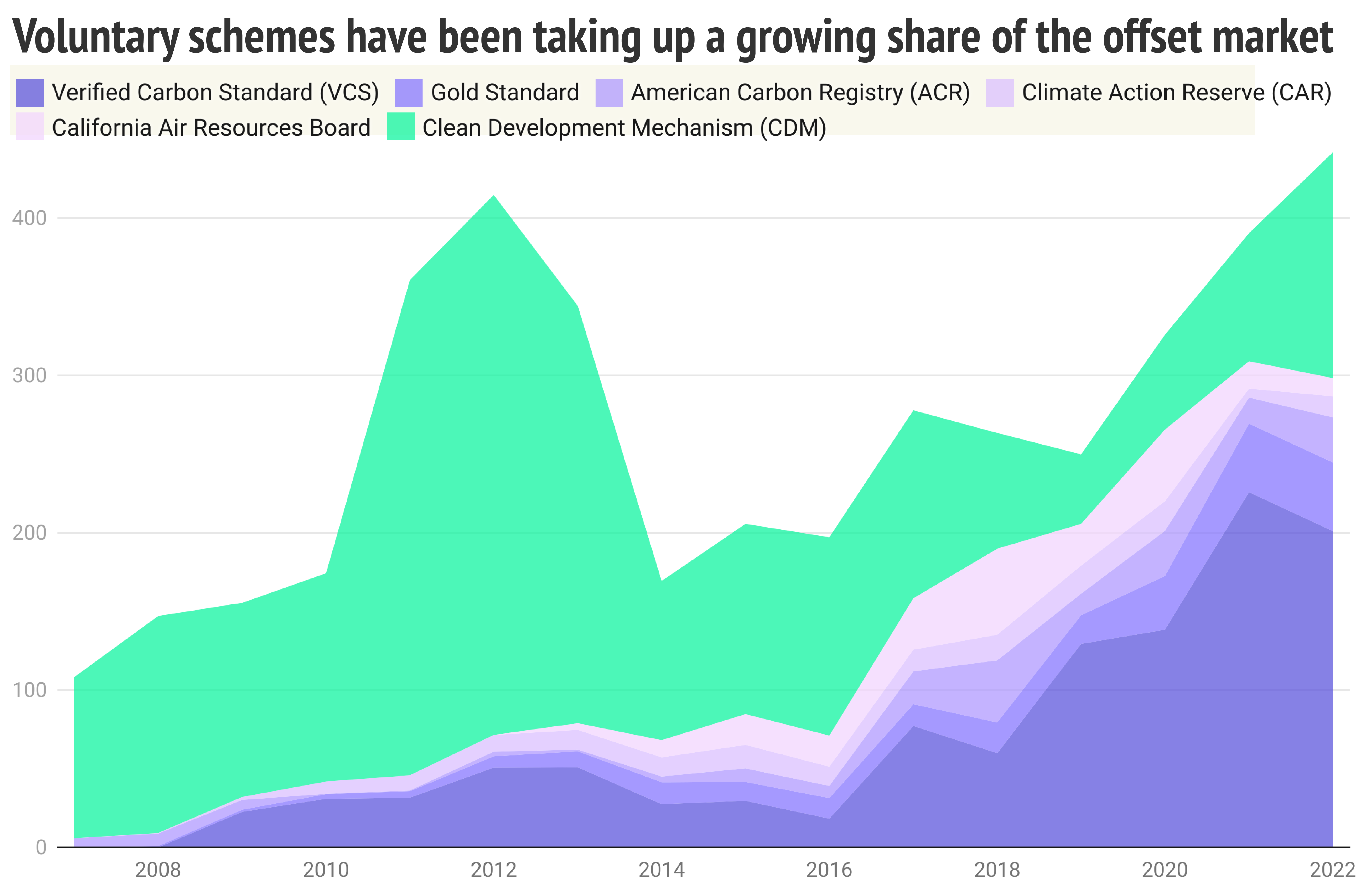

The voluntary market is underpinned by standards and registries such as the Verified Carbon Standard (VCS) – light blue in the chart below – which accounts for nearly two-thirds of the voluntary market and is administered by the NGO Verra.

The chart below, which shows the number of credits issued by different registries each year, demonstrates the growing dominance of these standards (shades of purple) compared to the UN’s Clean Development Mechanism (CDM – green).

It demonstrates how demand has grown beyond companies and countries investing in CDM offsets solely to meet their obligations under emissions trading schemes and the Kyoto Protocol. (For more on the CDM, see: How are countries using carbon offsets to meet their climate targets?)

Unlike UN-backed credits, the organisations issuing these voluntary market offsets are NGOs and private entities. They have their own frameworks for verifying and issuing credits.

(The division between “voluntary” and “compliance” markets is complicated by the fact that businesses can also buy compliance offset market credits – for example, from the CDM – to make voluntary claims, if they wish. At the same time, compliance programmes such as Corsia or California and Quebec’s cap-and-trade scheme allow participants to purchase an approved subset of voluntary offset credits to meet compliance targets. Credits issued for the latter scheme are indicated by the California Air Resources Board section of the chart above.)

On top of the standards, there is a supporting ecosystem of auditors who check that offset projects are working as they are supposed to, as well as exchanges and retailers who trade in offsets and act as middlemen in transfers. The infographic below outlines the steps involved in the production, certification and sale of offsets, along with problems that can occur along the way.

What happens to emissions when you purchase a carbon offset?

1

London, UK

Charlotte Arbon buys a plane ticket from the airline Woop Air and pays extra for trees to be planted in Kenya.

Risk: Offsets can provide Charlotte with justification for continuing a high-emitting activity.

2

London, UK

Woop Air claims it is a net-zero airline that offsets its emissions through its FlyZer0 programme.

Risk: The claim relies on offsets that might exaggerate their ability to reduce emissions.

3

Oslo, Norway

Woop Air has a partnership with GoGreenest, a business that buys offsets in bulk and sells them to companies.

Risk: Both Woop Air and the Kenyan government can claim to have reduced their emissions with the same offsets, raising the risk of “double counting”.

4

Denver, US

Green Action Services Group is a consultancy and project developer managing climate-related programmes in Kenya and selling offsets they generate to GoGreenest.

Risk: Offsets are not bought directly from the project and instead pass through middlemen, meaning less money for those at the bottom.

5

Nakuru, Kenya

The owner of the tree-planting site is the Kenya Forest Carbon Initiative, which works on the ground with farmers and with Green Action Services Group to register offsets.

Risk: Developers could overstate the amount of CO2 emissions that are being removed by their tree-planting projects.

6

Zurich, Switzerland

The credits sold by Green Action Services Group have been certified and issued by the Real Carbon Registry, a non-profit, based on its own set of standards.

Risk: Investigations have revealed that many offsets in registries are “junk” because they are old or based on questionable methodologies.

7

Washington DC, US

An auditor from Sustaino Solutions Inc, a validation and verification body, travels to Kenya to ensure the Green Action Services Group projects are up and running.

Risk: They are chosen by the project developers, raising an impartiality risk.

8

West Kenya

Local farmers plant stands of trees in places once occupied by other crops.

Risk: Scores of investigations have uncovered evidence of carbon offset projects forcing local people from their homes and farmland.

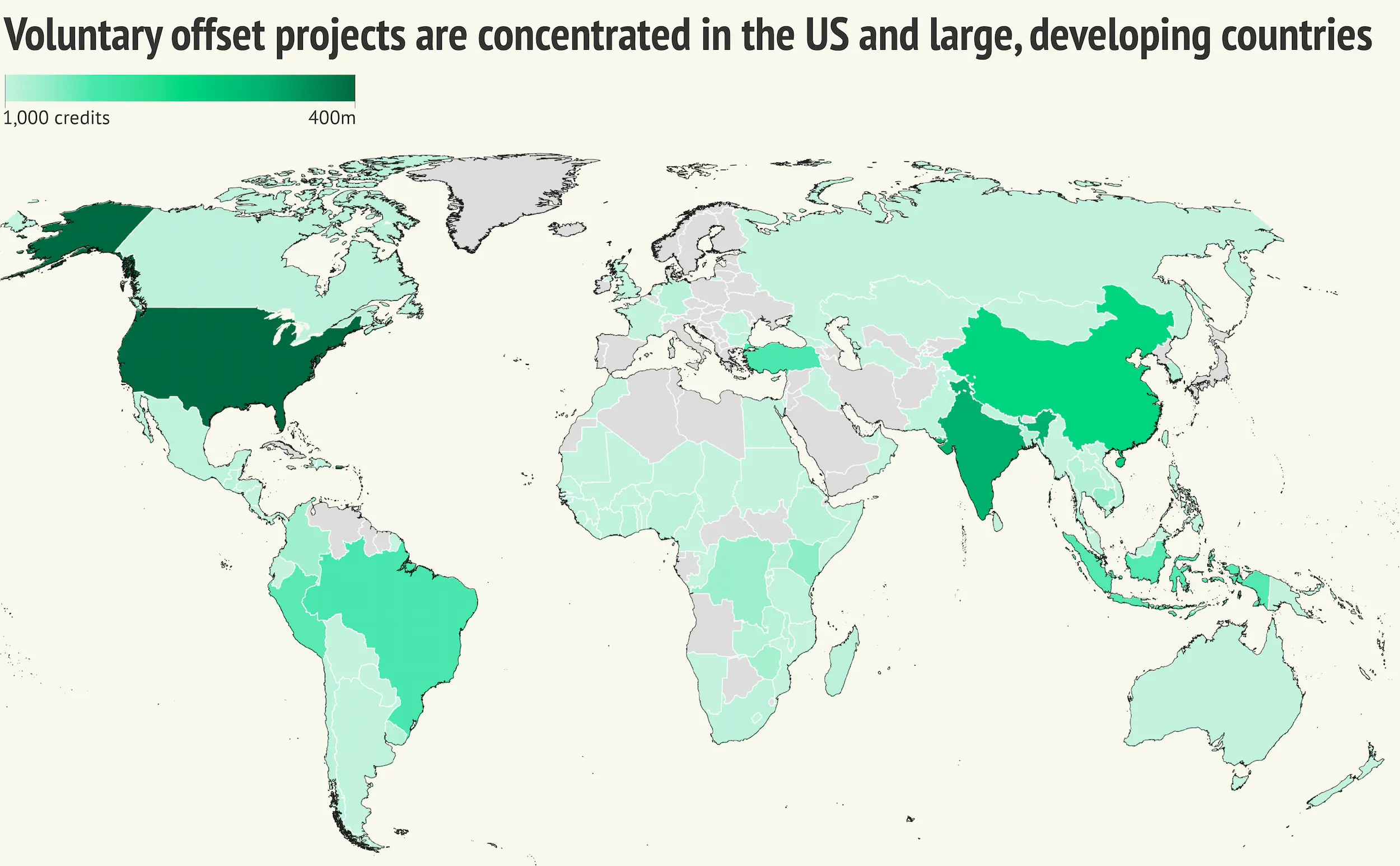

According to Carbon Brief analysis of data collected from the four largest voluntary offset project registries by the Berkeley Carbon Trading Project, three-quarters of the 1.8bn voluntary offsets issued are from projects in developing countries, as the map below shows.

As with the CDM, large, emerging economies, such as China and India, have generated a lot of these credits, with 16% and 12% of the total, respectively. As have countries with sizable forests, such as Peru and Indonesia.

Nearly all of the remaining credits are from the US, which is the largest issuer. However, roughly 90% of its credits come from primarily US-based registries, such as the American Carbon Registry, which are, in turn, largely purchased by US-based organisations – often to meet legal targets.

A report released by Shell and Boston Consulting Group found the voluntary offset market reached a record $2bn in 2021, four times larger than the previous year. It estimated the market would reach $10-40bn in value by 2030 – and many players in the sector have projected “exponential” growth for voluntary offsets in the coming years.

(This is still far smaller than the value of “carbon markets” more broadly. The trading of permits on the EU ETS and other regional emissions trading schemes was valued at $851bn in 2021.)

There is a disconnect between predictions of growth and the recent backlash against the voluntary offset market.

Prices of voluntary carbon offsets have plummeted over the past year. Investors have been hit by the economic downturn, but there are also broader concerns about the integrity of voluntary offsets. Dr Barbara Haya, director of the Berkeley Carbon Trading Project, tells Carbon Brief:

“The market is in a lot of flux right now and there are two factors pulling in opposite directions where you have all of these carbon-neutral and net-zero targets. So there’s growing interest from buyers to buy offsets, but then also a growing realisation that the market is deeply broken and almost all credits are over-credited.”

(For more on why most offsets are over-credited, see: Do carbon-offset projects overestimate their ability to reduce emissions? and Why is there a ‘double-counting’ risk with carbon offsets?)

Such issues have led to the Science Based Targets Initiative, an organisation that sets guidelines for corporate climate policy, stating unambiguously:

“The use of carbon credits must not be counted as emission reductions toward the progress of companies’ near-term or long-term science-based targets.”

At the same time, Haya adds that offsets can help to promote emissions reductions within businesses.

“Many companies would not have taken on carbon-neutrality goals if it weren’t for that option to buy cheap carbon credits,” she says. Analysis by carbon credit-rating company Sylvera found companies that were investing in offsets were simultaneously cutting their actual emissions at twice the rate of companies that were not.

Efforts to improve the market (see: Is there a way for carbon offsets to be improved?) are underway and Pedro Chaves Venzon, from industry group IETA, tells Carbon Brief that the voluntary market could also help develop methodologies and quality standards for use in international compliance markets:

“While they may not be perfect, they can play a key role in the planet’s journey to net-zero as they can help governments to build the infrastructure required for countries to develop compliance systems and engage with Article 6.”

In conclusion, Haya tells Carbon Brief:

“I think it’s absolutely essential that we fix quality before growing the market, otherwise you have an even bigger market standing on a house of cards which is going to collapse when there’s scrutiny.”

Do carbon offsets overestimate their ability to reduce emissions?

One major criticism of carbon offsetting schemes is that they can often, for various reasons, overstate their ability to reduce emissions.

This can be intentional or unintentional. (For more on intentional efforts to overstate the benefits of carbon offsets, see: Why is there a risk of greenwashing with carbon offsets?)

Understanding the ways in which carbon-offset projects can overestimate their ability to cut emissions is important.

This is because, by design, carbon offsets do not lead to a net reduction in emissions entering the atmosphere – but rather aim to allow an entity to “cancel out” their pollution by paying for another entity to pollute less. If the entity paid to pollute less has overestimated its ability to do so, it will lead to a net increase in emissions, exacerbating climate change.

Most carbon-offset projects around today involve “emissions reductions”, whereby an entity can compensate for its pollution by paying for emissions to not happen somewhere else.

This is most commonly achieved by entities subsidising, say, the creation of new renewable energy projects in the place of fossil fuel schemes, supporting projects that supply clean cookstoves in the global south or projects that protect ecosystems in order to avoid more deforestation. (More on this in: What are ‘carbon offsets’?)

Each of these approaches come with risks, says Gilles Dufrasne, global carbon markets lead at the independent watchdog Carbon Market Watch. He tells Carbon Brief:

“For all three you have strong scientific evidence on how there is a massive risk of overestimation in terms of the impacts that these projects are having.”

A recent preprint – a study that has not yet completed the peer review process – estimated that just 12% of carbon-offset projects around today “constitute real emissions reductions”.

There are several ways in which overestimates of emissions reductions can occur.

The first comes from the way that projects measure their ability to reduce emissions, says Dufrasne:

“The big problem with these projects is setting the baseline. When you measure the impact of your project, what are you comparing it to? You’re comparing it to what would have happened in the absence of your project. That counterfactual is quite difficult.”

For example, a forest protection project will generate a certain number of carbon credits to sell on to polluters based on how much deforestation the project developers think they have stopped from happening.

Research shows that forest protection schemes often overestimate how much deforestation they have prevented – and, thus, the amount of emissions they have been able to offset.

One study examining 12 forest protection projects in the Brazilian Amazon found that they consistently overestimated how much deforestation they had prevented.

An investigation by the Guardian, the German weekly Die Zeit and SourceMaterial, a non-profit investigative journalism organisation, published earlier this year found that 90% of the rainforest protection schemes approved by Verra, the world’s largest carbon offsets standards agency, had grossly overestimated the amount of emissions they had saved. Verra strongly refuted the allegations.

An analysis by carbon credit ratings agency Calyx Global found that 70% of clean cookstove projects significantly overestimated their ability to reduce emissions.

And a separate investigation by the Guardian published in September found that the majority of carbon-offset projects that have sold the most carbon credits did not deliver on promised emissions reductions.

Another way that overestimates occur comes from assumptions about how long offset projects can keep carbon locked up. This concept is often called “permanency”.

During a transaction, buyers purchase credits – each representing one tonne of CO2 – with the assumption that an equivalent amount of carbon will be offset somewhere else.

However, this transaction does not consider whether the amount of CO2 offset will stay out of the atmosphere permanently.

This is particularly a problem for forest protection schemes, Dufrasne explains:

“The CO2 you’re emitting into the atmosphere when you burn fossil fuels is going to stay there for centuries to millennia, but the carbon stored in forests – we don’t know how long that is going to stay there. So, there is no equivalence between storing carbon in forests and avoiding the combustion of fossil fuels.”

The carbon stored inside forest protection schemes is at risk from myriad factors.

This includes political and economic changes, which may affect deforestation rates, as well as climate change, which is making tree-killing events, such as wildfires and droughts, more likely. (See: Could carbon-offset projects be put at risk by future climate change?)

This “permanency” risk is well illustrated when a fossil-fuel company pays for its emissions to be offset by a forest-protection scheme, says Dufrasne:

“You’re basically shifting the storage from a very stable carbon pool – fossil fuels trapped under the ground – to a very unstable pool, which is carbon in forests. In the short term, you could say it’s the same thing – it’s one tonne of carbon. But in the medium to long term, it’s not the same thing.”

The risk of overestimates worsens still through another concept known as “additionality”.

This term refers to a conundrum carbon-offset financers often face: how can they really be sure that the money they provided via carbon credits was the deciding factor in the project going ahead – and, thus, the resultant emissions reductions?

This is particularly an issue for renewable energy schemes. While these needed subsidies in the past, price reductions mean renewables such as solar and wind are now cheaper than fossil fuels in most countries – meaning there is already a good economic case for funding such projects without carbon credits, Dufrasne explains:

“For many renewable energy projects, it’s quite unlikely that revenues from carbon credits would make any difference to the economic viability of these projects. In other words, they would have happened anyway.”

The additionality risk associated with renewables is so great that many of the largest registries for voluntary carbon offsetting, such as Verra and Gold Standard, do not allow new renewable energy projects on their books.

(However, it remains undecided whether renewable energy projects will still be able to receive offsetting finance from countries under the Paris Agreement.)

A related concept to additionality is “attributability”.

This refers to the worry that, even if a project would not have gone ahead without carbon credits, how can financers be sure that the emissions reductions achieved are attributable to the project itself – and not some other factor related to politics, economics or the environment?

An example of this issue could occur with a forest protection scheme in the Brazilian Amazon, says Dufrasne.

In 2022, left-wing “zero deforestation” advocate Luiz Inácio Lula da Silva swept to power after a four-year term of Jair Bolsonaro, a far-right president who oversaw an acceleration in Amazon deforestation. Dufrasne explains:

“Let’s say we have a carbon-offset project that’s being implemented between Bolsanaro and Lula’s terms. The project might claim to have stopped deforestation and offset lots of carbon. But how much of that is actually down to the project rather than the change in political leadership?”

Another related issue is “leakage”. This refers to the worry that introducing a carbon-offset project in one region could lead to new emissions happening elsewhere. For example, if a forest protection scheme opens across one stretch of the Amazon, deforesters may simply respond by logging another area of the forest that is not under any protection.

A smaller proportion of carbon offsets around today work by aiming to remove CO2 from the atmosphere to compensate for an entity’s emissions elsewhere.

This is commonly achieved by planting trees, which remove CO2 from the atmosphere as they grow, or by restoring damaged ecosystems, which are natural carbon stores.

As with emissions reductions, offsets that remove CO2 from the atmosphere can often come with risks of overestimates occurring.

Prof Ian Bateman is an environmental economist at the University of Exeter and director of NetZeroPlus, a research project that is examining how the UK could remove emissions from the atmosphere through tree-planting and restoring ecosystems.

He tells Carbon Brief that tree-planting is fraught with intricacies and complications that – if not carefully considered and managed – can lead to overestimates of emissions reductions occurring and – in the worst cases – more carbon being added to the atmosphere:

“Very often, we don’t know what the net carbon consequences of what we’re doing actually is.”

An example of tree-planting gone wrong occurs when forests are planted over peatlands, he says.

Peatlands are waterlogged environments with extremely carbon-rich soils. Past tree-planting schemes have drained peatlands in order to plant forests – unintentionally causing vast quantities of carbon once trapped in soggy soils to be released into the atmosphere, Bateman explains:

“You get this problem of ‘global warming forests’. If you’re planting in the wrong area, you can emit more carbon than you store by a long way – I’m not talking a bit, I’m talking multiples of the amount of carbon that a tree can store.”

Does he worry that carbon-offset project developers may not have the capacity to take into account the many risks associated with tree-planting?

“Yeah, absolutely. Globally, we need tools – provided by scientists – that people can use to allow them to understand these risks.”

Why are there ‘double-counting’ risks with carbon offsets?

Another criticism of carbon offsets is they can be fraught with risks of “double-counting”.

“Double-counting” is when two entities use the same emissions reduction towards meeting their climate targets.

There are various ways that double-counting can happen.

One way that double-counting might occur, in theory, is when a country pays for a carbon-offset project in another country. The risk here would be that both countries count the same emissions reductions achieved by the project towards their own climate targets, giving an inflated picture of how both countries are doing on tackling emissions globally.

However, at the COP26 climate summit in Glasgow in 2021, countries agreed to new rules under the Paris Agreement to stop this kind of double-counting from occurring, says Gilles Dufrasne, global carbon markets lead at the independent watchdog Carbon Market Watch.

“If a country buys a carbon credit, then the country where the project is being implemented cannot count that project towards its international climate pledge. So, let’s say the US buys credits in the Brazilian Amazon, the US can use that towards its international climate target – but Brazil cannot.”

Another way that double-counting might occur is when a private company pays for a carbon-offset project in another country. The risk here would be that the country where the carbon-offset project is located counts the emissions cuts towards its climate target, while the company uses the same emissions reductions to make claims about reducing its carbon footprint or achieving net-zero.

Under the Paris Agreement, this kind of double-claiming is currently not completely prevented from happening, Dufrasne explains:

“So, you could have, [hypothetically], Microsoft buying carbon credits in the Brazilian Amazon. Brazil will use those emissions reductions for its international climate target and Microsoft will use it to say they are carbon neutral. That is where we think there is a double-claiming risk with two entities counting the same emissions reduction.”

In other words, if the company pays for one tonne of carbon to be stored in the Brazilian Amazon – both the company and Brazil can individually claim that they have offset one tonne of carbon.

This is – in theory – not actually a problem for the Paris Agreement. That is because only countries have to report their emissions under the agreement. So, it would only be Brazil that would claim they have offset their emissions under the framework.

However, groups such as Carbon Market Watch argue that this sort of double-claiming is highly misleading for consumers. In addition, it can raise an “additionality” risk, says Dufrasne.

“Additionality” refers to a problem carbon-offset financers frequently face: how can they really be sure that the money they provided via carbon credits was the deciding factor in the project going ahead – and, thus, the resultant emissions reductions? (See more in: Do carbon-offset projects overestimate their ability to reduce emissions?)

Dufrasne explains:

“If you have [a company such as] Microsoft counting the same reduction as Brazil, how can Microsoft be sure it’s not just paying for something Brazil was going to do anyway?

In other words, if the private sector provides enough cash through carbon credits to reduce Brazil’s emissions by a sizable amount, Brazil might no longer feel the need to introduce new policies to tackle its emissions itself. Dufrasne continues:

“The private sector is sort of substituting what the government was planning to do anyway. It’s not a bad thing in itself to support developing countries, but it’s not the same thing as delivering additional tonnes of CO2 reductions.”

At the COP27 climate summit in Egypt in 2022, negotiators did come up with a new concept to try to reduce the risk of double-counting by companies and countries.

They agreed to establish a new type of carbon credit known as a “mitigation contribution”. This type of credit would allow countries hosting carbon-offsetting projects to count the emissions reductions achieved towards their climate targets, but not the companies responsible for funding the project. Instead, the company would “contribute” to the emissions cuts in the host country, making these credits effectively a form of climate finance.

Another – less talked-about – way that double-counting can occur is when carbon-offset projects overlap.

The risk of overlap is particularly high for forest-protection schemes and clean cookstove initiatives, says Dufrasne. (See: What are carbon offsets?)

Both schemes claim to reduce emissions by stopping deforestation. (Clean cookstove projects aim to reduce deforestation by providing people in the global south with fuel-efficient cookstoves, meaning they no longer have to cut down trees for firewood.)

If a cookstove project and a protected forest initiative are active in the same area, there could be a risk that both projects assume that the drop in deforestation they’ve measured is just down to them alone, Dufrasne explains:

“Currently, there aren’t specific rules to address that.”

An analysis by carbon credit ratings agency Calyx Global found that more than half of energy efficient cookstove projects are co-located in areas where projects claim emission reductions from protecting forests. It said it was not possible to determine the full extent of double-counting between the two types of offsetting projects.

Another possible way for double-counting to occur is through how carbon credits are traded in markets.

At present, carbon-offsets registries must mark when a carbon credit has been “retired” – namely, used by a buyer. (Find out more about how registries work: How are countries using carbon offsets to meet their climate targets?)

However, registries do not always provide information about who used the credit – potentially leaving a loophole for exploitation, says Dufrasne:

“There’s very little transparency about what happens to the credits once they are on the market. In theory, there could be unscrupulous brokers selling credits to multiple clients, saying: ‘I’ve retired the credit for you, you can see it in the registry.’

“I have no proof this ever happens, it’s just a possibility.”

Why is there a risk of greenwashing with carbon offsets?

Accusations of “greenwashing” against companies – and even governments – have climbed as the use of carbon offsetting has grown.

Offset purchases have led to firms making misleading claims about “carbon-neutral” airlines, fossil fuels and international sporting events.

Dr Barbara Haya, the director of the Berkeley Carbon Trading Project, tells Carbon Brief:

“We know that offsets are undermining direct action in some cases. We know that offsets are also making us believe the fiction that we can fly guilt-free, that we can buy carbon-neutral gasoline, and that’s never the case.”

According to Prof Gregory Trencher, an energy-policy expert at Kyoto University:

“The fundamental definition of greenwashing refers to a situation when the climate benefits that are claimed by a particular company don’t match the reality. And I think we see a very clear trend with certain companies, looking at their offsetting practices, if we look at the kind of benefits that are claimed by these particular projects.”

A 2023 study that Haya led found “shortcomings” among each of the three major voluntary offset market registries that generate credits by “improved forest management”. According to the authors, all three registries “risk over-crediting” for projects. The paper called for a “higher burden of evidence for quality” of offsets.

So-called “bogus” or “junk” credits are not a new problem. The US Federal Trade Commission (FTC), the country’s consumer-protection agency, was investigating “fraudulent carbon trading” as early as January 2008, National Public Radio reported at the time.

Many companies demonstrate a “clear preference” for purchasing avoidance credits over removal ones, since the avoidance credits are significantly cheaper than removal credits – even though the former are “a little bit misleading”, Trencher says. He tells Carbon Brief:

“If we put ourselves in the position of the consumer, or a stakeholder, we’re assuming that when a corporate activity is conducted [and] that amount of CO2 is released into the atmosphere, we’re assuming that that’s somehow physically removed and compensated for.”

Similarly, companies often purchase cheaper, “aged” offsets – offsets issued for projects that were established years or even decades ago – rather than the more expensive, newer ones.

But if credits are being issued for, say, a project that was built 15 years ago, “the effect of that project on lowering emissions in the world today is extremely questionable”, Trencher says. Offsets should have a “stronger temporal association between the polluting activity and the activity that’s used to mop up these emissions”, he adds. “This window is really, really stretched in many situations.”

Trencher co-authored a 2023 study that examined the net-zero strategies and offsetting behaviours of four major oil companies. It found that none of the companies had plans to transition away from fossil fuels, instead relying on offsets to reach net-zero emissions. The authors concluded:

“These findings challenge the appropriateness of claims about ‘carbon-neutral’ hydrocarbons, showing how net-zero strategies omit the urgent task of curbing the supply of fossil fuels to the global market.”

Pushing back against the notion that carbon offsets give companies a “licence to pollute”, a report from Sylvera, a carbon-credit-rating company, found that purchasing offsets was associated with actual emissions reductions.

Among 102 companies across a range of sectors, those who purchased credits reduced their direct emissions and those related to their energy consumption by a combined average of 6.2% per year over 2013-21, while those that did not reduced their emissions by an average of 3.4% per year. (See: How are businesses and organisations using carbon offsets?)

Nevertheless, increased scrutiny of companies’ net-zero pledges has developed into a trend of litigation against these companies for false or misleading advertising, often on the basis of their carbon offset use.

Glossary: Carbon Brief’s guide to the terminology of carbon offsets

The definitive guide to carbon offsets terminology, covering everything from the frequently-used to the obscure.

The years of 2021 and 2022 each saw more than 25 lawsuits filed over misleading “climate-washing” claims, according to the Grantham Institute’s 2023 “Global trends in climate change litigation” report.

And this number is likely an undercount, since the database used in the report does not capture motions filed in administrative or consumer-protection bodies, explains Catherine Higham, a policy fellow at the Grantham Research Institute on Climate Change and the Environment at the London School of Economics and Political Science. She tells Carbon Brief:

“These are representative of the fact that we have so many industries trying to make these claims about carbon neutrality, relying often on offsetting.”

Unlike lawsuits that have been brought on the basis of human rights or for climate-related damages, claims brought on the basis of greenwashing have typically been resolved relatively quickly – and often in favour of the plaintiffs, Higham says. She tells Carbon Brief:

“We have seen a significant number of successes where courts have said that whatever the advertising campaign is, it is misleading and isn’t particularly well-substantiated.”

Additionally, such lawsuits are being filed against a “really diverse set of players”, Higham says – not just traditionally high-emitting industries such as fossil-fuel companies, automobile manufacturers and airlines, but also banana growers, cleaning product companies and both dairy and non-dairy milk producers.

In March 2022, UN secretary-general António Guterres established the High‑Level Expert Group on the Net-Zero Emissions Commitments of Non-State Entities. The group, whose membership comprised a range of experts, including researchers, policymakers and business executives, produced a report on their findings, called “Integrity Matters: Net Zero commitments by Businesses, Financial Institutions, Cities and Regions”.

In the report, the group lays out a range of recommendations for these “non-state actors” to establish effective net-zero plans, including that they “prioritise urgent and deep” emissions reductions, rather than relying primarily on offsets.

At the report’s launch in COP27 in Sharm el-Sheikh, Guterres told the room:

“We must have zero tolerance for net-zero greenwashing…Using bogus ‘net-zero’ pledges to cover up massive fossil fuel expansion is reprehensible. It is rank deception.

“The absence of standards, regulations and rigour in voluntary carbon market credits is deeply concerning. Shadow markets for carbon credits cannot undermine genuine emission reduction efforts, including in the short term. Targets must be reached through real emissions cuts.”

The report provides a strong foundation for plaintiffs to build their lawsuits upon going forward, Higham says, pointing out that it is “just one of quite a lot of efforts” among governments and other groups to establish standards and regulations for the use of offsetting.

Trencher notes that as scrutiny around the use of offsets has increased, messaging from companies has shifted, putting increased focus on the quality of offsets. He adds:

“This correlation between offsetting and greenwashing has been, I think, acknowledged now as a real risk for offsetting companies.”

Why do carbon-offset projects come with side effects for Indigenous peoples and local communities?

Another major criticism of carbon-offset projects is that they often come with side effects for local communities, particularly Indigenous peoples.

In the past two years, several high-profile media investigations have alleged that carbon-offset projects selling credits to companies ranging from the oil firms Total and Shell through to Disney, Meta and Netflix have led to serious impacts for local communities, including forcing Indigenous peoples out of their homes or farmland.

There have also been detailed investigations into how carbon offsets issued to countries under the Clean Development Mechanism – the UN’s first attempt to allow carbon trading between nations – have had serious impacts for people and nature.

For example, the Guardian in 2015 reported that a planned dam in Guatemala, which issued carbon credits for developed countries to buy under the CDM, was linked to the killing of six Indigenous peoples, including two children.

REDD+ projects that issue carbon credits from forest protection activities have been particularly damaging for Indigenous peoples.

This is due to some offset projects not complying with Indigenous peoples’ and communities’ rights over their territories, leading to some being forcibly removed from their homes or farmland.

Levi Sucre, a Costa Rican Indigenous leader and coordinator of the Mesoamerican Alliance of Peoples and Forests – which stretches from Mexico through to Panama – explains to Carbon Brief the importance of territory for Indigenous peoples:

“Those are ancestral lands. We have lived there for generations. It is important that countries respect the rights of Indigenous people. Otherwise, we would face an imminent dispossession of land, which means livelihoods, cultural uprooting and destruction of the people”.

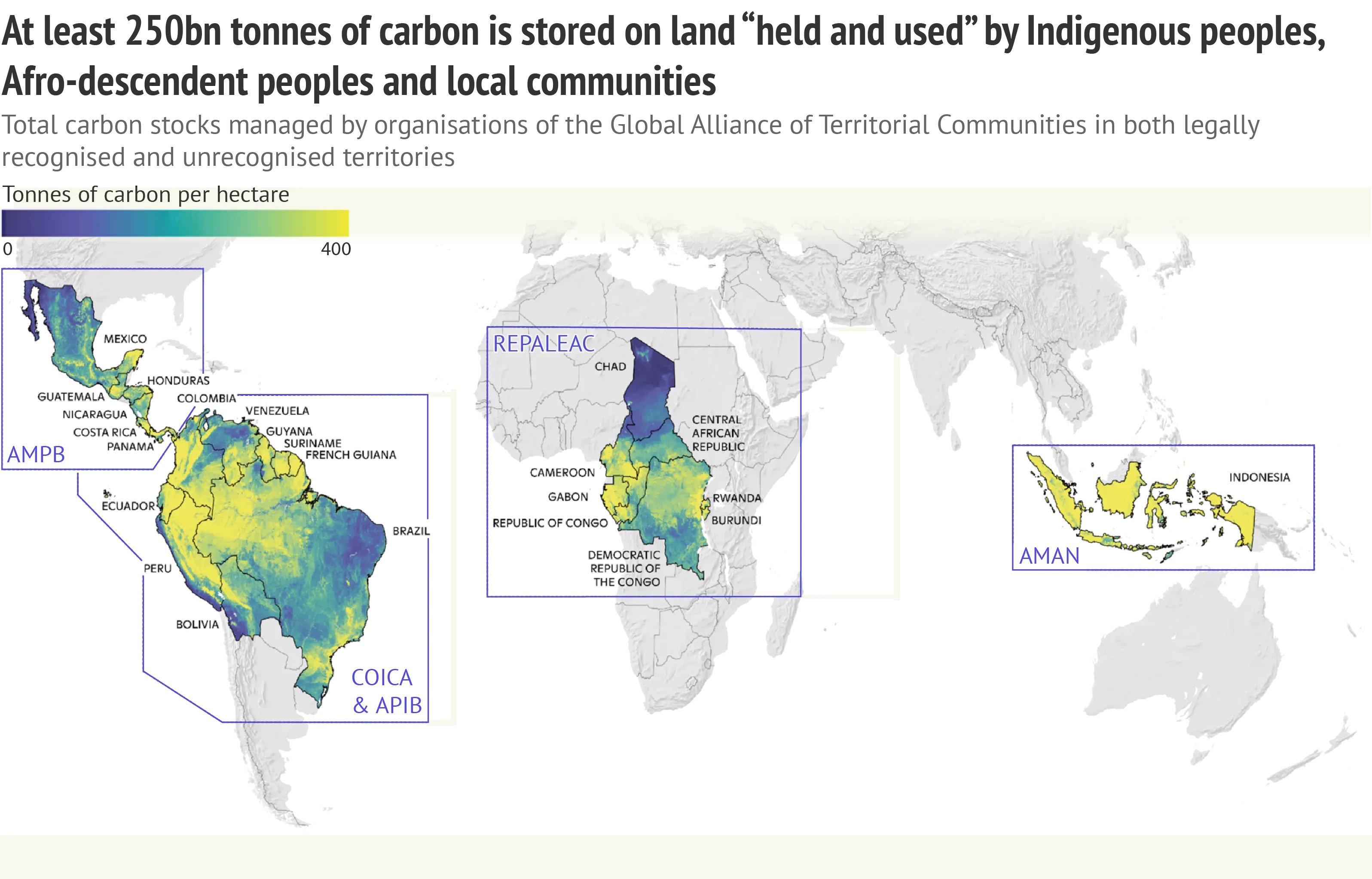

In a report published by the Rights and Resources Initiative (RRI), Woodwell Climate Research Center and Rainforest Foundation US, it is estimated that the land “held and used” by Indigenous peoples, Afro-descendent peoples and local communities store at least 253bn tonnes of carbon, which is distributed in the regions shown in the map below.

Another recent report by the RRI concluded that more than 1375m hectares of the land claimed by Indigenous peoples, Afro-descendent peoples and local communities has not yet been legally recognised.

Without legal recognition of land rights and, eventually, “carbon rights” – defined as the rights to the benefits generated from emissions reduction – communities are at risk of missing out on benefits from offset projects, according to Alain Frechette, director of strategic analysis and global engagement at the RRI. He tells Carbon Brief:

“Carbon rights are tied to land rights. But some countries are nationalising carbon rights, meaning that the government or the public owns the carbon that is in the trees that [Indigenous peoples] own, then what right do they have to use that tree and benefit from it?”

The International Labour Organization Indigenous and Tribal Peoples Convention (number 169), signed in 1989, is a key document when considering Indigenous rights in the context of carbon offsetting schemes.

The landmark agreement contains two important rights for Indigenous peoples. These are the right to self-determination and the right to free and informed consent “prior to the approval of any project affecting their lands or territories and other resources”.

The UN Declaration on the Rights of Indigenous Peoples, adopted in 2007, recognises Indigenous people’s rights to their lands – either legalised or traditionally owned – territories and resources. It also says that states “shall consult and cooperate” to obtain Indigenous people’s free and informed consent.

“These rights already exist; there is no excuse for them to be violated”, stresses Julián Trujillo, a researcher at Gaia Amazonas, an NGO providing guidance in human rights to Indigenous communities of the northeast Colombian Amazon.

However, the reality differs in various African and Latin American countries, which have reported breaches of these rights.

In the northernmost, heavily forested region of the Republic of the Congo, a REDD+ emission reductions programme approved in 2021 by the World Bank led to an unequal benefit-sharing plan for communities. Locals will only obtain 15% of the benefits, according to the organisation REDD-Monitor.

In southern Colombia, poverty and violence drove the Nukak Indigenous community to negotiate selling carbon credits to a national company in 2019, under an “irregular and disadvantageous” contract for Indigenous peoples, Mongabay reported.

Although the project did not materialise, it was criticised by the Indigenous community by the lack of consultation to obtain their free, prior and informed consent, as well as the lack of state support to help people in the community understand the contract and defend their rights.

The lack of state support could lead to further conflicts in the communities due to the misunderstanding of the contracts, said Horacio Almanza, a researcher at the Mexico’s National Institute of Anthropology and History who has worked with communities in the Tarahumara Sierra in northern Mexico.

It is not a matter of creating new rights, but rather situating them in the carbon credits context, Trujillo notes.

Some carbon offset-related rights were established at the COP16 climate summit, held in Cancun in 2010, which delivered a set of environmental and social safeguards to be “promoted and supported” in REDD+ projects in developing countries. These include respect for the knowledge and rights of Indigenous peoples and local communities.

But the Cancun safeguards were agreed upon until COP21 in 2015, and only 26 countries have submitted their safeguard system to UN-REDD – the body that oversees REDD+ projects – according to a new report by the Rainforest Foundation UK.

These safeguards are included in carbon credit certifications, says Sucre. However, the Mesoamerican Alliance of Peoples and Forests calls for offset certification companies, such as ART TREE, to account for the UN Declaration on the Rights of Indigenous Peoples in their certifications as well. Sucre stresses:

“When we want to complain to the certifier that they did not take into account [certain rights], and we want to appeal to that instrument [the UN Declaration on the Rights of Indigenous Peoples], we cannot do it because it is not within their standards.”

Human rights and the rights of Indigenous peoples have also been a contentious topic in more recent UN talks around Article 6 carbon markets.

While these issues have been acknowledged, Carbon Market Watch says they were not “strongly enough” referenced in the outcomes and there was no “specific requirement to obtain free, prior and informed consent from Indigenous peoples and local communities”.

Once a carbon offset project is established, problems related to the administration of the resources and benefits can emerge within the local communities, notes Almanza.

For Silvia Gómez, director at Gaia Amazonas, Indigenous peoples and local communities should be the holders and owners of the carbon offset projects. Her organisation works to help such communities manage their revenue streams and fairly distribute the profits.

There are additional mechanisms that Indigenous peoples, local communities and non-profit organisations are trying to boost to ensure their rights in carbon markets.

Almanza considers that communities could put formal complaints before international courts “as it has been done recently and with good results”.

Finally, speaking on the condition of anonymity, an expert on human rights and Indigenous communities consulted by Carbon Brief says that in some Latin American communities, organised crime has already taken over illegal logging, but it could expand to carbon offset projects if institutions do not tackle the problem and end with impunity.

“The funds could go to those who are now controlling forest management processes”, he warned.

Could carbon-offset projects be put at risk by climate change?

Forest protection is a common form of carbon-offset project.

Around 40% of the credits that have been issued on the voluntary market come from forest protection, management and, to a lesser extent, creation, according to Carbon Brief analysis of data from the Berkeley Carbon Trading Project.

But climate change leaves an uncertain future for how the carbon storage of trees will fare under rising temperatures and more extreme weather events.

Prof Ian Bateman describes the main climate-related risks as the “four horsemen” of the “tree apocalypse”: pests, disease, fire and wind.

Forest fires are already having a noticeable impact on offset projects.

Canada’s recent wildfires burned vegetation at an offset project. A forest offset programme funded by companies including Microsoft and BP was also impacted by US fires in 2021.

Dr Shane Coffield, a postdoctoral researcher in Earth system science at the University of Maryland, does not believe future climate risks are sufficiently considered in offset projects. He tells Carbon Brief:

“If the carbon is going to go back to the atmosphere in 50 years [due to extreme weather], that just means that we haven’t offset our emissions. We actually contributed to making the problem worse.”

Coffield was the lead author of a study assessing the climate impacts on ecosystem carbon storage in California – a state that has generated around one-tenth of the forestry-related voluntary offsets on the market, according to Berkeley data.

The study found that projected carbon storage declines were “particularly high in areas that already have offset projects”, highlighting that there is a “lot of uncertainty”, Coffield says. (See: Do carbon offsets overestimate their ability to reduce emissions?)

Extreme weather is often taken into account in offset projects through a “buffer pool” – carbon credits set aside to cover any future harm that might befall an offset project.

This insurance mechanism aims to guarantee that the purchased credits will still be valid, even if the project is damaged down the line by fire, drought or other issues.

A 2022 study found that wildfires have already used up almost one-fifth of the California forest carbon offsets programme’s 100-year buffer pool. This is equivalent to 95% of the contributions specifically intended to cover all fire risks.

This indicates that California’s insurance is “severely undercapitalised” and unlikely to be able to guarantee the programme’s “environmental integrity” for 100 years, the study said.

The lead study author, Grayson Badgley, a research scientist at climate solutions non-profit CarbonPlan, says buffer pools generally seem to be “far too small”. He tells Carbon Brief:

“If we don’t get the buffer pool right, we have the chance of actually having the programme make climate change worse [and] justifying emissions. So we have to have the numbers absolutely precise.

“We expect drought to get worse in the future. We expect wildfires to get worse in the future. We’re already seeing both of those things happen and I don’t know of a programme that actually takes those sort of shifting baselines into account.”

Offset programmes update their risk assessments as more evidence emerges, but Badgley says not all factor in specific and sufficient risks, both now or in the future.

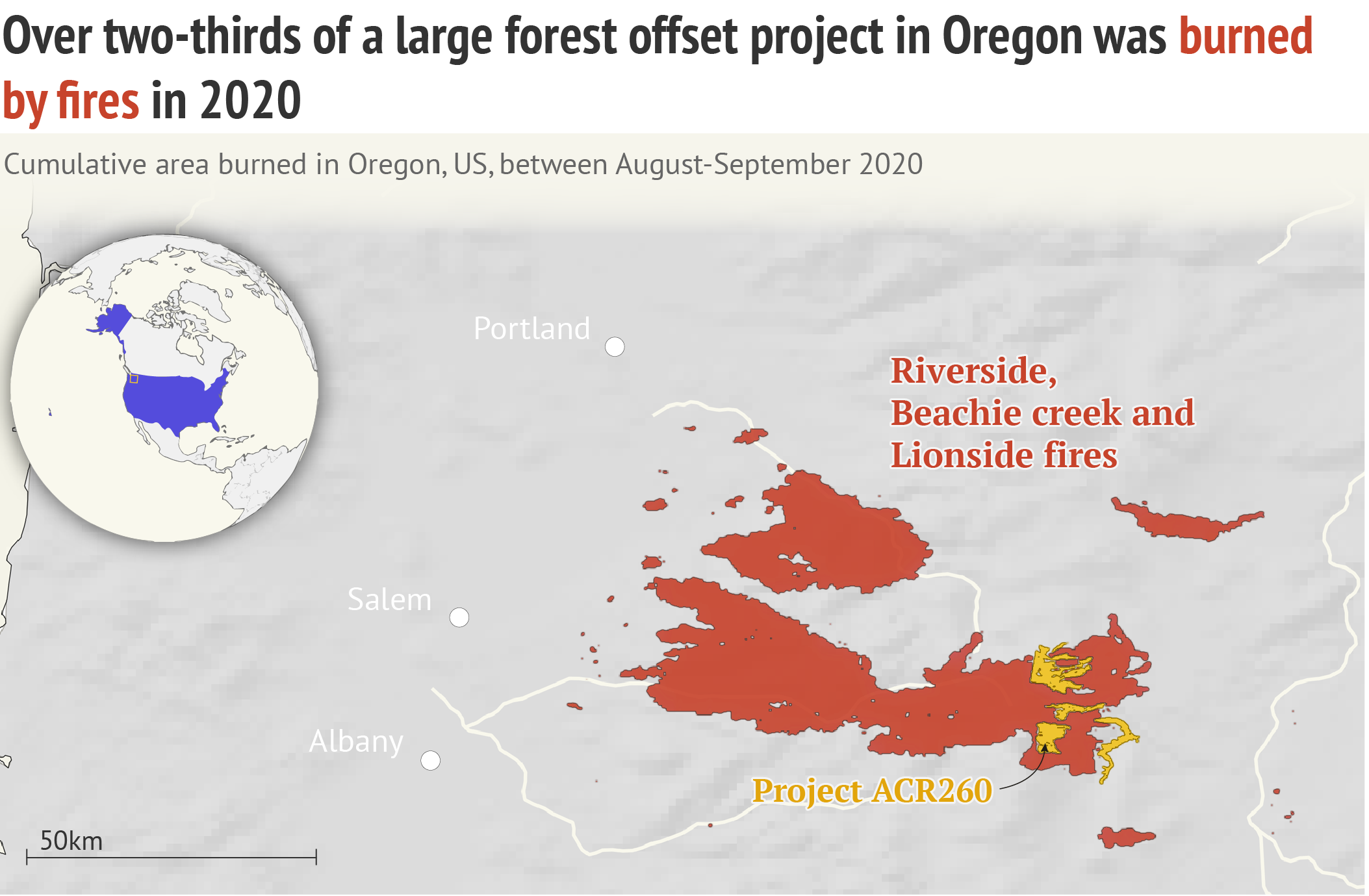

The map below shows how a fire burned through some of a forest offset project in Oregon during an intense fire season in the western US in 2020.

Further effects of climate change also impact forests and other ecosystems. Rising temperatures and drought may lead to widespread regional tree mortality, according to the IPCC.

Coffield notes that temperature “has a huge influence on drying out vegetation” which can lead to plant stress. He adds:

“The temperature’s going up, the rainfall in some places might go up or down, but certainly not enough to compensate for that increased water demand associated with the temperature and the wildfire risk.”

This rising water stress could affect the rate that plants and trees grow via photosynthesis, reducing their ability to remove CO2 from the atmosphere, research suggests.

Currently, forest protection project developers are not required to consider how plants may absorb less CO2 in future when making estimates about how much carbon their projects could offset over time.

Tipping points, where climate change could push parts of the Earth’s system into abrupt or irreversible changes, could also have an impact on land carbon storage.

Another threat is tree pests and diseases, which are spreading more rapidly to different parts of the world due to trade and climate change.

Badgley notes that these uncertainties around future climate-related impacts on trees means offset calculations may become “more mixed up” in future. He adds:

“We’re potentially banking on these forests to do more help in fighting climate change than they’re capable of.”

Is there a way for carbon offsets to be improved?

Carbon-offset providers are facing intense pressure to reform as buyers show less willingness to invest, amid mounting public, media and legal scrutiny of their climate benefits.

Numerous efforts have been launched to improve carbon markets in recent years.

Negotiations around Article 6 carbon markets under the Paris Agreement have given countries an opportunity to build a new UN system that improves on the flawed Kyoto Protocol markets, such as the Clean Development Mechanism (CDM).

Along the way, many civil society groups and countries have championed “high-integrity carbon markets” – for example, with the San Jose Principles.

Ultimately, while observers have welcomed some improvements in the Article 6 system, there remain outstanding issues that could – if left unresolved – compromise their ability to drive meaningful emissions cuts and avoid harming communities. (See: How are countries using carbon offsets to meet their climate targets?)

Article 6 rules are still being developed, including the methodologies and baselines for issuing credits. Ultimately, this will govern what type of credits are allowed under Article 6.

Scott Vaughan from the IISD, tells Carbon Brief:

“There’s still stuff that they’re negotiating. There’s always going to be tweaking to some parts of the rules, because it’s complicated. I think they did the right thing though, saying, look, here’s the framework and here are the standards. But here’s a bunch of things that we need to finalise.”

Meanwhile, as it expands rapidly, the voluntary offset market has seen a slew of efforts to improve what remains a largely unregulated system. Among them have been the Integrity Council for the Voluntary Carbon Market (ICVCM), the Voluntary Carbon Markets Integrity Initiative (VCMI) and the Science Based Targets initiative (SBTi).

The Oxford Principles for Net Zero Aligned Carbon Offsetting, which were unveiled in 2020, set out four core principles for the sector:

As the Oxford principles state, the market for such high-quality offsets is currently “immature and in need of early-adopters”.

As the chart below shows, just 3% of credits on the four main registries in the voluntary market, as captured by the Berkeley Carbon Trading Project database, have been issued for carbon removal – coloured red in the figure below – all of them for tree-planting projects. None of the major registries have issued credits for long-term storage, such as in geological reservoirs.

There has been growing recognition from the sector that some of the offsets on sale are lower quality than others.

In the voluntary offset market, efforts to avoid lower quality credits include the two largest offset certifiers, Verra and Gold Standard, both stopping issuing credits from grid-connected renewable projects except in least-developed or lower-income nations in 2019.

This reflects the reality that renewable projects in relatively wealthy nations are now economically attractive investments without offset money and, therefore, provide no additionality. This means offset purchasers should not be claiming responsibility for the emissions reductions provided by the projects.

Yet there are still many credits available on the market that could undermine the climate action promised by the principle of carbon offsetting.

For example, credits issued by projects started under the Kyoto Protocol before 2020 remain available, despite question marks over how “additional” the associated emissions cuts are.

These credits will be labelled, meaning buyers can clearly differentiate them.

This is highlighted in research from Trove Research and University College London (UCL), which proposes that companies buying offsets can help limit the use of older, poor quality credits.

Above all, credits created under the CDM must be prevented from “polluting” today’s voluntary offset market, Guy Turner, lead author of the study said at the time of publication.

Speaking to Carbon Brief, Turner expands:

“I personally would like to see less of them used. Because I think we need to invest new money in new projects, rather than meet our current demand for that stuff that was already there.”

(For more on criticism of CDM credits and details of how they may be used under the new Article 6 carbon market, see: How are countries using carbon offsets to meet their climate targets?)