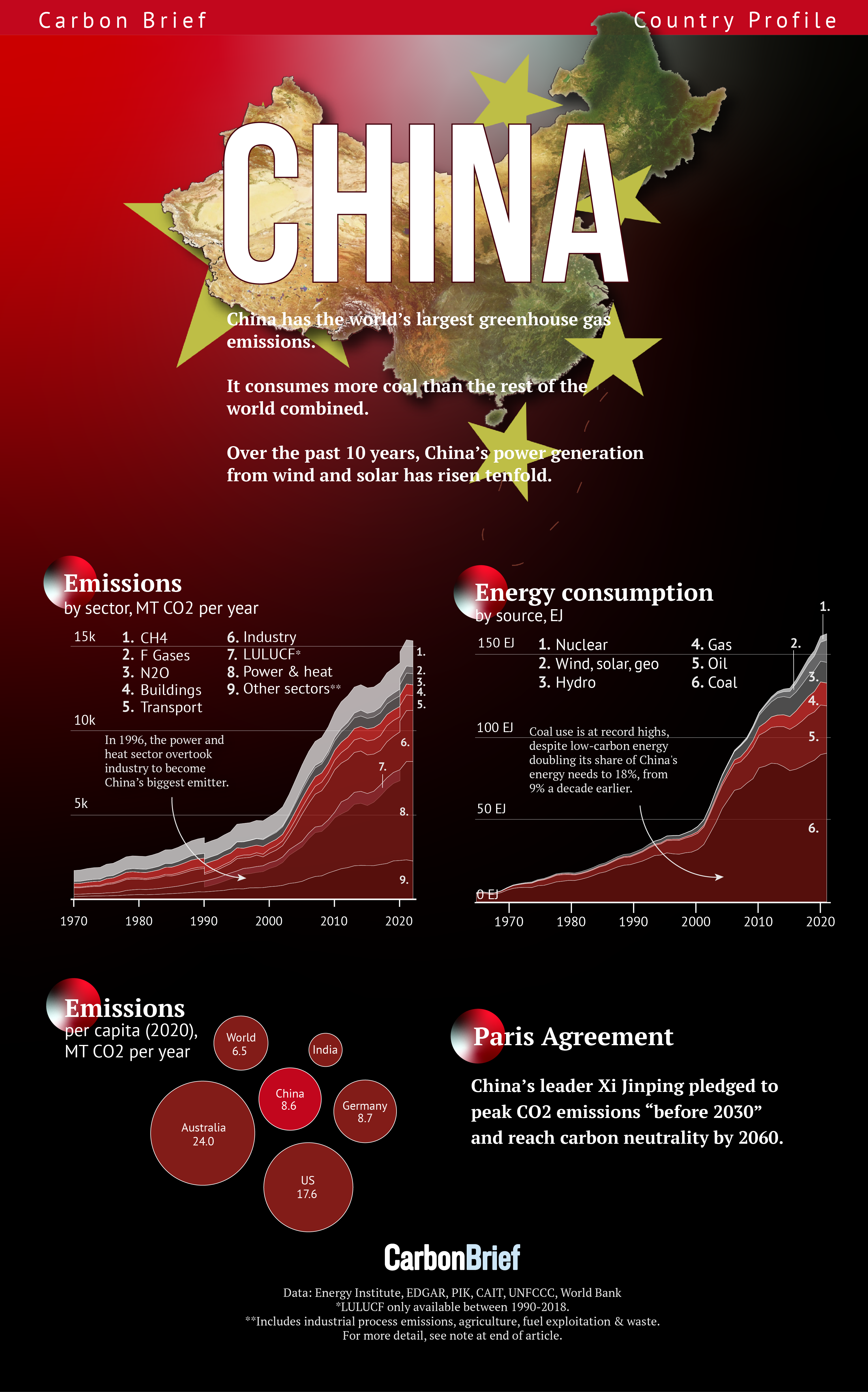

As part of a series on how key emitters are responding to climate change, Carbon Brief looks at China, which leads the world in terms of greenhouse gas emissions and coal use – but also on the deployment and manufacture of low-carbon technologies.

By Hongqiao Liu, Simon Evans, Zizhu Zhang, Wanyuan Song and Xiaoying You

Design by Joe Goodman and Tom Prater

China, formally known as the People’s Republic of China, is the world’s second-largest economy and the second most populous country.

The country is home to half of the world’s coal power plants and has the world’s largest capacity of renewables and hydroelectricity, as well as the second-largest for nuclear.

It is also the world’s fifth-largest oil-producer and the second-largest for oil consumption, as well as the single largest contributor to global growth in demand for gas.

Carbon Brief Country Profiles

Select a country from the series

In 2006, China overtook the US to become the world’s largest annual emitter of greenhouse gases and its citizens now have carbon footprints well above the global average. However, its cumulative and per-capita emissions remain about half of the US’s today.

Climate change is a priority for the ruling Communist Party of China (CPC) and the Chinese government. In 2020, China’s leader Xi Jinping pledged to “peak carbon dioxide emissions before 2030” and “achieve carbon neutrality before 2060”.

- Politics

- Paris pledge

- Climate policies and laws

- Fossil fuels

- Renewables

- Hydro and nuclear

- Industry

- Agriculture and forests

- Transport

- Impacts and adaptation

- Notes

Politics

China is the world’s largest socialist state, second-largest economy after the US and second-largest country by landmass after Russia. Home to more than 1.4 billion people, China is also currently the world’s second most populous country.

Although estimates of the specific year vary, many economists project that China will overtake the US to become the world’s largest economy over the next decade.

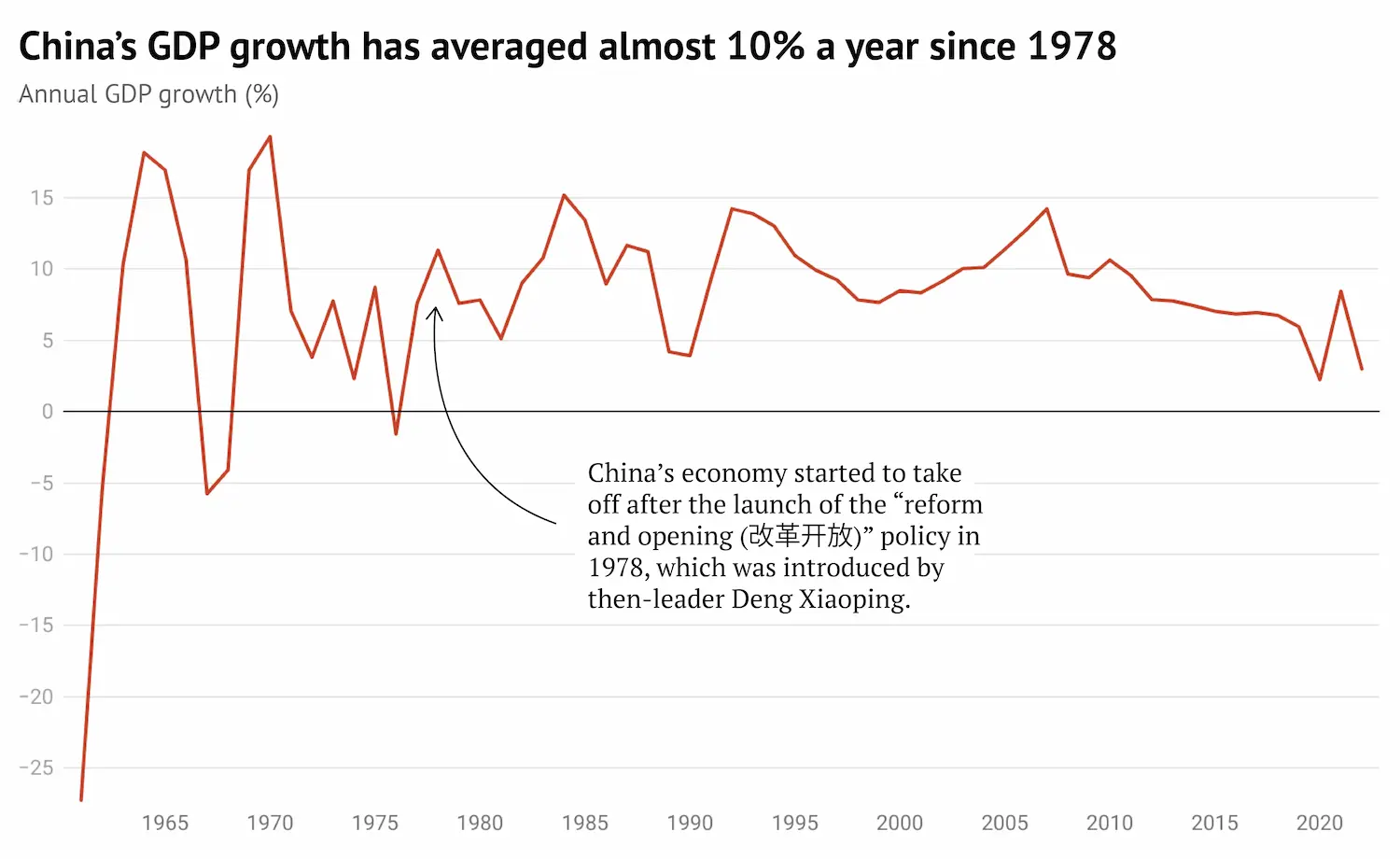

China’s economy started to take off after the launch of the “reform and opening (改革开放)” policy in 1978, which was introduced by then-leader Deng Xiaoping.

Since then, China’s GDP growth has averaged almost 10% per year, resulting in a nearly 100-fold increase over four decades.

More recently, China’s economy has been slowing down, with potentially profound implications for global energy markets and carbon dioxide (CO2) emissions.

China’s political system is “socialism with Chinese characteristics” under the leadership of the Communist Party of China, according to its constitution.

Sign-up to Carbon Brief’s award-winning China Briefing

The communist party governs the State Council (also known as the central government), as well as more than 30 jurisdictions – provinces, municipalities, autonomous regions and special administrative regions.

Contrary to many peoples’ belief, China also has eight minor political parties, such as the China Democratic League and the China National Democratic Construction Association. These groups can only provide political consultation to the ruling communist party.

Every March, the eight minority parties along with business leaders, academics and elites appointed by the communist party gather in Beijing for the Chinese People’s Political Consultative Conference, an advisory body similar to the House of Lords in the UK, but without any voting rights on legislation.

The March gathering is part of a national political event commonly known as the “two sessions”. This refers to two large meetings: the consultative conference and the annual meeting of the National People’s Congress, China’s top legislative body.

An important part of the “two sessions” is to approve the communist party’s pre-written annual and five-year plans for economic and social development. Since the party holds a majority at the meetings, it is almost guaranteed there are no surprising voting results.

(Carbon Brief has explained the significance of the “two sessions” and “five-year plans” in an in-depth Q&A. The 14th five-year plan, launched in 2021, covers 2021-2025.)

The communist party has a parallel legislative body called the National Congress of the Chinese Communist Party, which meets every five years. It is where big decisions and events, such as communist leadership elections, usually take place.

At the most recent of these events in 2022, Xi Jinping was once again voted as the leader of the party and the military, starting his third term.

Seven other men were elected with Xi onto the highest leadership group, the Politburo Standing Committee of the Chinese Communist Party. The sixth ranking member, Ding Xuexiang, is expected to be China’s next top decision maker on climate change policy.

Xi has been a key figure in China’s shifting stance on climate change. (See Carbon Brief’s analysis on nine key moments that changed China’s mind about climate change.)

Under “Xi Jinping Thought” – a series of key ideas and policies derived from Xi’s speeches and writings – China strives to build an “ecological civilisation”, for which “green is gold” and “man and nature coexist harmoniously”.

Climate action also falls into this framework. Since 2014, officials’ performance ratings – a key criterion for promotions – started to include the implementation of climate goals.

Public attitudes towards climate change in China have fluctuated. In a 2015 Pew survey, only 18% of interviewees said climate change was a “very serious problem”, a significant decrease from 41% in 2010.

But according to a 2020 survey carried out by China Youth Climate Action Network (CYCAN) – a Guangzhou-based non-profit organisation – 46% of young people considered climate change as the “most serious global issue” today and 86% believed that China played a key role in global climate governance.

Paris pledge

China is the world’s largest annual greenhouse gas emitter.

In 2020, it emitted 12.3bn tonnes of CO2 equivalent (GtCO2e), amounting to 27% of global greenhouse gas emissions, according to the CAIT database maintained by the World Resources Institute (WRI). This includes emissions from land use, land-use change and forestry (LULUCF).

China has been participating in the international climate negotiations under the United Nations Framework Convention on Climate Change (UNFCCC) since it was first initiated in the early 1990s.

It is a “non-Annex I” party to the convention, meaning it is not obligated to contribute climate finance and was not required to make binding emissions cuts under the Kyoto Protocol.

It continues to position itself as “the world’s largest developing country”, despite its growing economy, energy use and emissions.

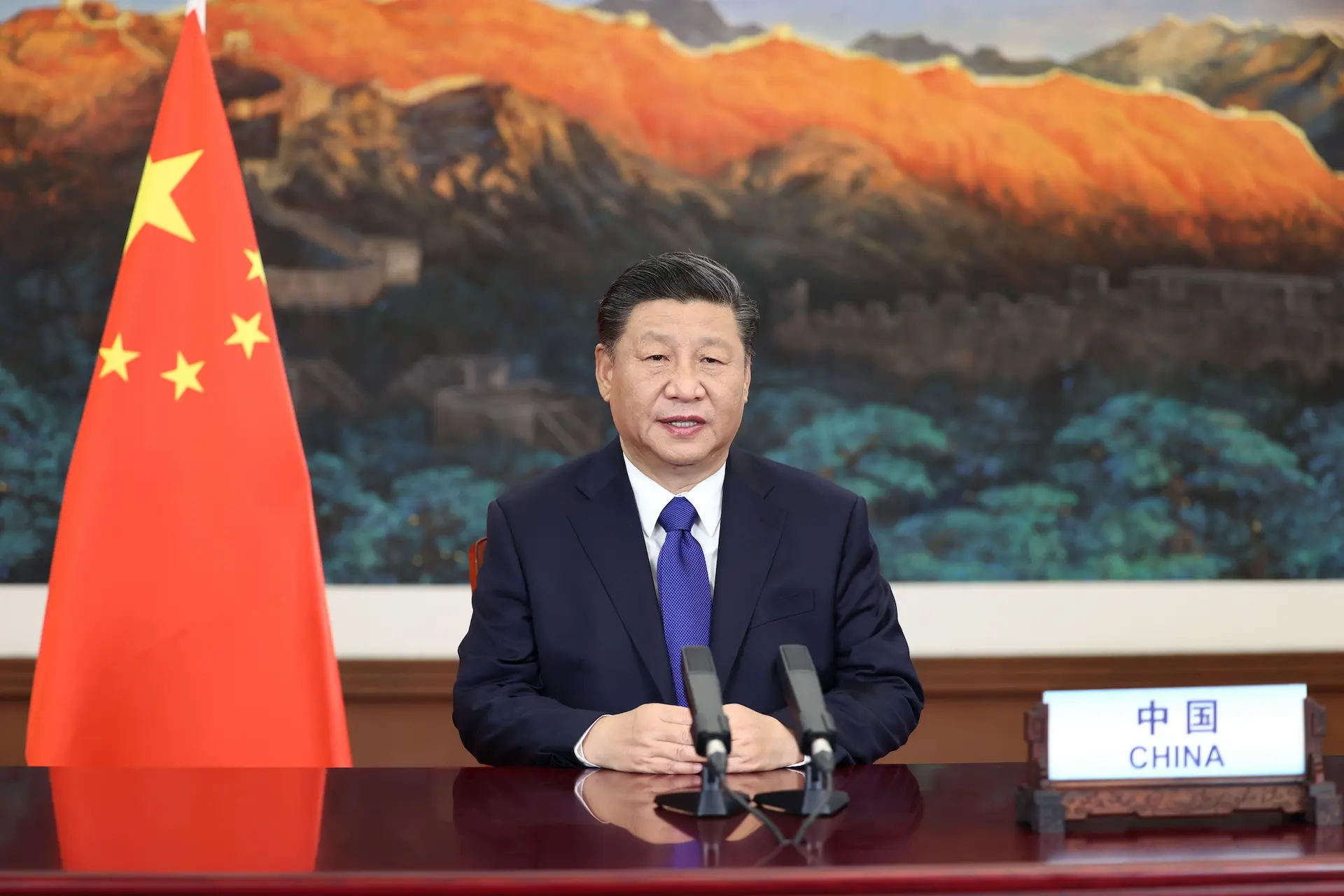

Chinese President Xi Jinping addresses the Climate Ambition Summit, 2020. Credit: Xinhua / Alamy Stock Photo.

In climate talks, China sits in three UN reporting groups, or party groupings: Group of 77 + China, BASIC and Like-Minded Developing Countries (LMDC). In addition, it co-issues bilateral declarations with major economies such as the US and EU on climate change.

In 2009, China was among the countries that endorsed the non-binding Copenhagen Accord at COP15, where negotiations on a new global climate regime had failed. Under the accord, China pledged to reduce its CO2 intensity – the emissions per unit of GDP – by 40-45% below 2005 levels and to get 15% of its energy from low-carbon sources by 2020.

According to Xie Zhenhua, China’s climate envoy, China’s CO2 intensity reduced by 48.4% in 2020 compared to 2005 level. The share of non-fossil fuel in primary energy consumption reached 15.9% in 2020, achieving China’s climate pledges for 2020 ahead of schedule.

Since China became the largest emitter in 2006 and the second-largest economy in 2009, it has been facing increasing international pressures to upgrade its climate ambitions.

Countries including the US have led calls for a re-evaluation of responsibility for cutting emissions between developed and developing countries, and specifically, pressing China to reflect its status as an upper middle – soon to become high – income economy.

Glossary: Decoding how China talks about energy and climate change

A detailed guide to the jargon – from the frequently used to the obscure – appearing in China’s climate-related lexicon.

Despite being the biggest emitter today, however, China’s 11% share of cumulative emissions since the industrial revolution is much smaller than that of the US (20%), which has a population of one quarter the size of China.

China also ranks lower than many other major economies when it comes to per-capita emissions. In 2019, its per-capita emissions were slightly higher than the global average, but similar to Germany’s, about half those of the US and one-third those of Australia’s.

In 2014, China and the US issued a joint announcement on climate change, which injected critical momentum to the signing of the Paris Agreement a year later.

On 30 June 2015, China submitted its first “intended nationally determined contribution” (INDC), in which it pledged to peak CO2 emissions “around 2030” and “make best efforts to peak early”. China was one of the first major countries to ratify the Paris Agreement.

Other INDC targets for 2030 included lowering CO2 intensity by 60% to 65% below 2005 levels, increasing the share of non-fossil fuels in primary energy consumption to around 20% and increasing the forest stock volume by around 4.5bn cubic metres from the 2005 level of 13bn cubic metres (35%).

Although China considers itself a developing country, it did not request climate finance from developed countries parties in its INDC. Instead, it established a “south-south cooperation fund” in 2015, pledging 20bn yuan ($3.1bn) in funding to support other developing nations tackle climate change.

The fund was launched in 2015, as part of the Obama-Xi Joint Statement prior to the Paris climate talks.

China has also made it clear that it would not participate in the Green Climate Fund (GCF) for developing countries, either as a donor or a beneficiary.

On 22 September 2020, China’s leader Xi Jinping made a surprise announcement that China would “scale up its NDC and aim to have CO2 emissions peak before 2030 and achieve carbon neutrality before 2060”. (The two goals for 2030 and 2060 are often referred to as the “30-60 goals” or “dual-carbon goals” in the Chinese context.)

At the UN climate ambition summit in 2020, Xi further stated that China would “adopt more vigorous policies and measures” for 2030, including to lower CO2 intensity by over 65% below 2005 levels, increase the share of non-fossil fuels in primary energy consumption to around 25%, and increase the forest stock volume by 6bn cubic metres (46%).

These targets were formalised in China’s updated NDC submitted to the UNFCCC just before the Glasgow COP26 climate talks in late 2021. In addition to tightening the targets set in 2015, the updated NDC commits to at least 1,200 gigawatts (GW) of installed capacity of wind and solar power by 2030 – a target widely expected to be met years early.

The US and China issued further joint climate statements in 2021, including a surprise declaration during the COP26 summit where they agreed to work together to tackle the “climate crisis” in this “critical decade”, with action in areas such as methane emissions, “phasing down” coal and protecting forests.

A further joint statement, issued in November 2023, backed a global goal to triple renewable energy capacity by 2030 “so as to accelerate the substitution for coal, oil and gas generation…anticipat[ing] post-peaking meaningful absolute power sector emission reduction”. It did not include agreed language on phasing fossil fuels down or out.

The following table shows China’s key climate pledges to date, as well as progress towards meeting them, based on public information disclosed by the Chinese government.

| 2015 NDC (targets for 2030) | 2021 NDC (targets for 2030) | 2020 progress | Latest figures | |

|---|---|---|---|---|

| Reduction of CO2 emissions per unit of GDP (compared to 2005) | 60-65% | More than 65% | 48.4% | 50.3% (end of 2021) |

| Non-fossil share in primary energy use | Around 20% | Around 25% | 15.9% | 17.5% (end of 2022) |

| Forest stock volume increase (compared to 2005) | Around 4.5bn cubic metres | 6bn cubic metres | 4.6bn cubic metres | 6.5bn cubic metres (end of 2021) |

| Installed capacity of wind and solar power | – | More than 1,200GW | 543GW | 760GW (end of 2022) |

Although China’s updated 2021 NDC did not raise its headline ambition, the combination of targets it contains could still lead to a lower emissions peak being reached earlier than the officially stated goal of “before 2030”, various experts have told Carbon Brief.

Indeed, the International Energy Agency (IEA) World Energy Outlook 2023 found that China’s fossil fuel use would peak in 2024, before entering structural decline. This would imply falling energy-related CO2 emissions.

China’s CO2 emissions are set to fall and enter structural decline already in 2024, according to analysis for Carbon Brief of the latest trends as of the third quarter of 2023.

The analysis shows that record growth in low-carbon energy sources (see below) – and structural changes in the country’s economy – are behind this potentially seismic shift.

Climate Action Tracker (CAT), an independent scientific analysis of climate pledges, finds China’s revised NDC targets are “slightly more ambitious” than its original version.

However, it still rates them as “highly insufficient’” for falling outside of China’s “fair share” range and for being inconsistent with the 1.5C and 2C climate targets.

Climate policies and laws

The soviet-style economic planning today still plays a decisive role in China’s social and economic development, despite the country having been through major economic reform.

In particular, the “five-year plans” (FYPs) and “action plans” have the most influence on climate policies. (Read Carbon Brief’s Q&A on the latest 14th five-year plan.)

Notably, in the most recent 14th five-year plan released in March 2021, China introduced the idea of a “CO2 emissions cap”, though it did not put a specific number on this limit.

China’s long-term climate pledges for 2030 and 2060 were also written into the 14th five-year plan – making it the first five-year plan in the nation’s history to include climate goals. Three months later, China formed a “leaders group” to help deliver the targets. (See Carbon Brief’s explainer on the “leaders group”.)

China also aims to bring down CO2 intensity and energy intensity levels by 18% and 13.5%, respectively, over the course of the next five years. These targets are in line with those in the previous five-year plan period, triggering international concerns about China’s seriousness over its dual-carbon goals, which would have implied greater ambition.

More objectives and policy directions were specified in the central government’s 14 five-year plan for the energy sector, released in March 2022.

Officially titled as the 14FYP for a “modern energy system”, the overarching objective of the plan is to “accelerate” the development of a “modern energy system”, the essence of which is “clean, low-carbon, secure and efficient”, a government spokesman explained.

Some analysts suggested that the name of the document highlights the urgency and challenge China faces to decarbonise and secure its energy supplies at the same time.

According to the plan, the development of China’s energy system will surround around five main goals:

- “more safe and solid” energy security;

- “remarkably effective” low-carbon energy transition;

- “significant” increase of energy efficiency;

- “obvious” enhancement of innovation capacity;

- and “continuous” improvement of general energy services.

The plan requires non-fossil sources to supply “about” 39% of electricity generation by 2025. It also requires electricity to account for “about” 30% of final energy consumption by 2025.

The plan also did not specify caps for total energy consumption or coal consumption, which were both included in the 13FYP, nor did it provide a target for total electricity consumption.

The plan calls to enhance the “stability and security” of energy supplies chain. It specifically asks for an increase in the “supply capabilities” of gas and emphasises coal’s role in “ensuring basic energy needs” and providing flexible peaking services to the grid.

Instead of phasing out coal, the plan emphasises the need to retrofit existing coal plants to accommodate more renewable generation onto the grid. According to the plan, by the end of 2025, 200 gigawatts of coal units will be retrofitted and the ratio of flexible power sources in all generation will reach around 24%, which will be largely made up of coal power.

The following chart illustrates the introduction of major climate-related targets in China’s five-year plans.

| Coal | Non-fossil fuels | Energy | CO2 emissions | |

|---|---|---|---|---|

| 11FYP: 2006-2010 | New target on the share of renewable energy in primary energy use | New target on energy intensity | New indicator on avoided CO2 emissions from energy conservation | |

| 12FYP: 2011-2015 | New indicative target on the share of coal in primary energy use | New binding target on the share of non-fossil fuels in primary energy use | New “dual-energy caps”: a binding target on energy intensity and an indicative target on total primary energy use | New binding target on CO2 intensity |

| 13FYP: 2016-2020 | Coal share indicator becomes a binding target New indicative target on total coal use |

|||

| 14FYP: 2021-2025 | Introduced the principle of an “absolute cap” on CO2 emissions, without giving the exact value |

In the absence of a national climate law, most of China’s implementation of its climate targets flows via energy and environmental regulations. For example, several laws concerning environmental protection, air pollution, renewable energy and energy efficiency have elements that address climate change.

‘1+N’ climate policy

In October 2021, China’s central government issued “working guidance” on the country’s efforts to peak carbon emissions and achieve carbon neutrality and its action plan to peak CO2 emissions before 2030.

These two documents laid the foundation of China’s “1+N” climate policy system, a prominent development that will set directions and provide political guidance for China’s efforts to decarbonise.

The leaders group on China’s emissions peaking efforts, headed by vice-premier Zheng, is also responsible for delivering the 1+N plan.

The “1” in the system refers to the working guidance, under what it calls the “new development philosophy”, a theoretical framework endorsed by Xi to guide the country’s development. It sets the overarching objectives for the coming decades under Beijing’s “dual-carbon” goals.

The “N” are the action plans and measures for key sectors, according to an interview with an NDRC official.

A China Council for International Cooperation on Environment and Development (CCICED) analysis suggested that the NDRC has been delegated the policy-making power to decide what policies should be included as part of the 1+N design and will work with local authorities and government departments to coordinate the implementation of the action plans. Ten key sectors listed in the action plans are:

- Energy structure;

- Industrial transition;

- Energy saving and low carbon buildings;

- Green and low-carbon transportation;

- Circular economy;

- Technology innovation;

- Green finance;

- Supporting economic measures and reforms;

- Carbon market and carbon pricing;

- and nature-based solutions.

‘DUAL HIGH’ PROJECTS:

“Dual-high” projects is a term used by Chinese authorities to refer to projects with “high” energy consumption and “high” emissions. The two “highs” used to stand for “high” energy consumption and “high” polluting, but their definitions have evolved since president Xi Jinping pledged in late 2020 that China would peak carbon emissions before 2030 and achieve carbon neutrality before 2060. In April 2021, Xi instructed senior officials that “high energy consumption and high-emission projects that don’t meet requirements should be resolutely taken down” to help the country hit its emission targets. Xi did not explain what the requirements were in his speech.

In 2021, the Central Ecological and Environmental Inspection Team (CEEIT), a special inspection unit led by the CCCPC and the State Council, started to incorporate the implementation of peak emission action plans and other climate targets, with a focus on “contain[ing] the blind development of dual-high projects”. (See Carbon Brief’s Q&A on the environmental inspectors.)

Around the same time, China’s top decision-making body gave new instructions on achieving the country’s climate goals in a “coordinated and orderly manner”.

The instructions also said that China should “establish before breaking”, first building low-carbon infrastructure before closing down polluting industries.

(See Carbon Brief’s article on interpretations of these instructions.)

Emissions trading scheme

China began operating a national emission trading scheme (ETS) in July 2021. It discussed introducing an ETS as early as 2011, but only began piloting seven local ETS from 2013.

The initial phase of the national ETS only covers the electricity generation sector, which accounts for more than 40% of the country’s energy-related CO2 emissions. Nevertheless, it is the world’s largest ETS in terms of covered emissions.

Signing ceremony for the carbon emission trading scheme in Beijing, 2013. Credit: Xinhua / Alamy Stock Photo.

Unlike other “cap-and-trade” schemes, China’s ETS does not set a fixed cap on CO2 emissions. Instead, each site received a free allowance for CO2 emissions based on its output and emission intensity “benchmarks”, which are measured in terms of emissions per unit of output and vary across different types and sizes of units.

As of 16 July 2023, two years after its official launch, the cumulative turnover of China’s ETS hit 11.03bn CNY ($1.54bn) and the cumulative volume of carbon emission allowances traded had reached 239.9m tons.

Both figures are much smaller than the EU ETS, which recorded transactions of 12.5bn tonnes of emissions allowances and registered an €865bn ($958bn) turnover in 2022 alone.

The launch of China’s ETS paralleled the approval of the EU’s carbon border adjustment mechanism (CBAM), a policy initiative to prevent carbon leakage by putting a carbon price on imported goods entering the bloc, unless they are subject to equivalent pricing at home.

Importers are obligated to report emissions from October 2023 and to pay for them starting in 2026.

China is among the exporters to the EU that will be heavily impacted by this policy. Industries that will be targeted first are cement, iron, steel, aluminium, fertilisers, electricity and hydrogen.

The China ETS planned to cover other energy-intensive sectors in the coming years, including petrochemicals, chemicals, building materials including cement, steel, non-ferrous metals, pulp and paper, power generation and aviation.

However, this progress is reported to have been delayed due to poor emission data.

In August 2022, three Chinese government agencies released a guideline regarding the development of a national system for CO2 emissions accounting and verification.

The document considers the establishment of emission verification mechanisms for emission-intensive industries such as steel and electricity – sectors also covered by CBAM – to be a “key task”.

Dual control

Since 2015, China’s central government has adopted the so-called “dual-control policy” to set targets for the country’s energy intensity and total energy consumption.

The energy intensity goal is usually a binding target, while local government efforts to meet energy consumption caps has, in some cases, resulted in power cuts in certain provinces.

The August 2021 instructions on carbon peaking warned officials that they should “rectify campaign-style carbon reduction”, taken to mean that economic development should not be sacrificed in the name of meeting targets.

Experts told Carbon Brief at the time that this implied a softening of tone on climate targets in the short term, but “not necessarily so in the long term”.

China’s central government first mentioned that the country should “create conditions” for a shift from controlling on energy intensity and consumption towards a dual control on carbon emissions and carbon intensity during its 2021 “central economic work conference”.

In July 2023, the central government released a series of policy documents and again emphasised a shift from “dual control” of energy to “dual control” of carbon. The set of policies also called for the reform of electricity, oil and gas markets.

Electricity market reform

To introduce more competition into its power sector, China has also initiated a series of reforms of its electricity market in the past two decades.

The country separated generation from grid utilities who supervised transmission, distribution and retail beginning in 2002. Since 2015, a new round of reform further separated transmission, distribution and retail, introduced a diversity of retail entities and allowed generation prices and retail prices to be determined by the market.

The reform also supported the establishment of electricity spot markets and the ancillary service market. Provincial-level pilot spot markets started operation in 2018.

In 2022, the NDRC and the National Energy Administration said that the country aims to form a unified national power market by 2030 and establish its preliminary structure by 2025.

In September 2023, the NDRC and the NEA released the “basic” rules for China’s power spot market. More specifically, the rule promotes the construction of inter-provincial, provincial and regional markets, as well as the integration of these subnational markets in the near term.

An analysis by energy experts from NGO Energy Foundation China suggested that spot trading of electricity in China would help “better reflect[] supply-and-demand and market costs in real time”, as well as promoting renewable energy consumption as such markets are “better suited to the volatility and unpredictability of new energy sources”.

China also released a national control plan for methane emissions on 7 November 2023. The plan was first mentioned by China’s climate envoy Xie Zhenhua during COP27.

According to the plan, China will improve policies and technical standards for methane emissions and enhance the capacity of methane emission monitoring and verification during the 14th and the 15th five-year plan periods out to 2030.

The plan also lists measures and actions for key sectors such as energy, agriculture and waste management, but does not set numerical targets for methane emissions reduction.

Fossil fuels

Over the past decade, China was responsible for about two-thirds of global oil demand growth, as well as one-third of gas growth and more than 90% of coal demand growth.

It is now the world’s largest coal consumer by far, as well as the second-largest oil consumer and the single largest contributor to gas demand growth.

Yet the IEA’s latest outlook says China’s fossil fuel demand is set to peak in 2024 and then enter structural decline, as rapid drops in coal use outweigh ongoing growth for oil and gas.

In 2022, fossil fuels accounted for 83.4% of the primary energy consumption in China. This is down from 97.5% in 1978, when China began market reforms and its “open-door” policy.

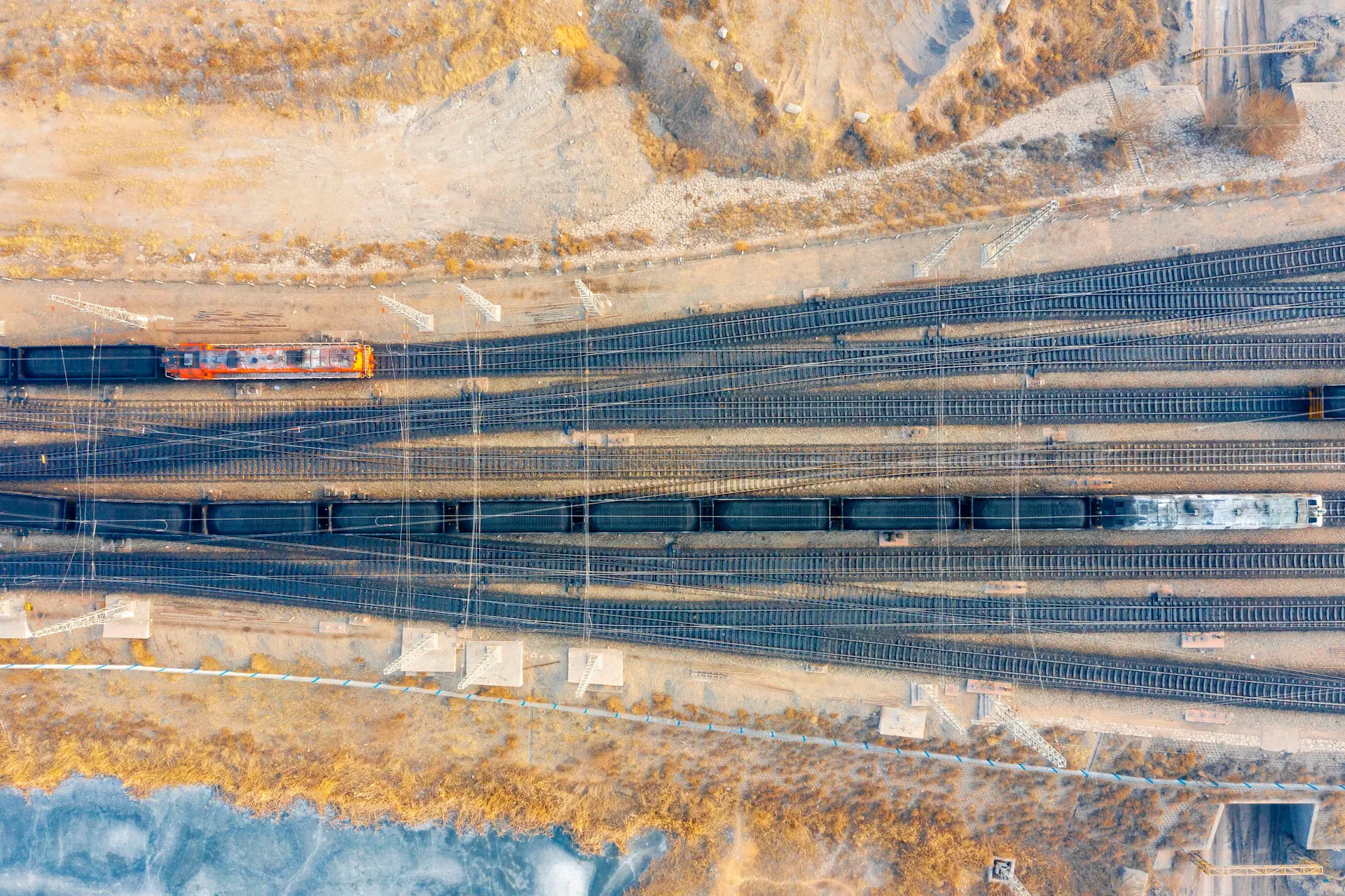

Coal trains wait to be transported at the Burtai coal mine in Inner Mongolia. Credit: Cynthia Lee / Alamy Stock Photo.

Coal

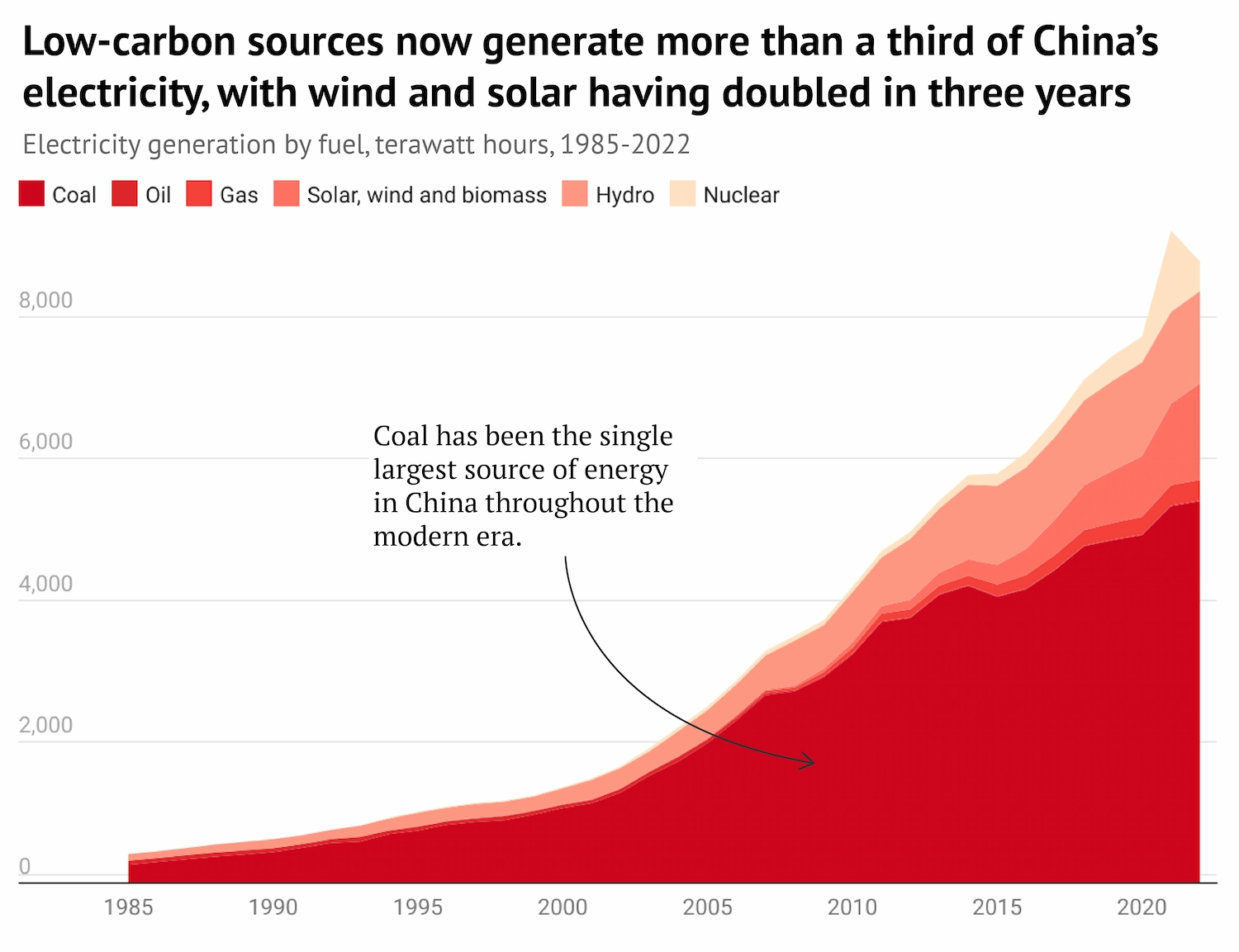

Coal has been the single largest source of energy in China throughout the modern era. While the share of coal in the energy mix decreased from 77% at its peak four decades ago to today’s 56%, coal consumption in China grew by 650% over the same period.

For decades, Chinese experts have been justifying the country’s heavy reliance on coal by reference to its resource endowment, which is “rich in coal, lacking oil and natural gas”.

These endowments have informed China’s approach to energy security, including its continued focus on coal, as well as the drive to develop domestic low-carbon energy supplies and supply chains for electric vehicles that cut the need for gas and oil imports.

(In fact, while its oil reserves are small in global terms, its gas reserves have recently grown rapidly, such that they now are only one-third lower than those of the US.)

China is the world’s largest coal producer, mining 4.56bn tonnes of coal in 2022. It is also the world’s biggest coal importer. It imported 293m tonnes in 2022 – mainly for thermal power generation – from countries including Indonesia, Australia and Russia.

China’s coal use doubled in the 10th five-year plan period (2001-2005). The expansion was stalled by the financial crisis in 2008, but quickly bounced back in 2009-2011.

In 2014, premier Li Keqiang declared a “war on pollution”, following the release of a five-year action plan on air-pollution prevention and control in 2013.

This led to major efforts including to shift homes from coal to gas heating and to close small coal-fired power plants near urban areas in favour of larger, more efficient units further away.

Around this time, China’s coal demand slowed to a temporary “peak” in 2013. This was followed by a period of decline – and coal use only returned to 2013 levels in 2019.

At the UN leaders summit on climate in April 2021, Xi said that China would “strictly limit the increase in coal consumption over the 14th five-year plan period” and “phase it down in the 15th five-year plan period”. This has been interpreted by some international observers as an announcement that China will “peak coal use in 2025”.

While the latest IEA outlook suggests this peak may come as early as 2024, China’s coal use has meanwhile continued to rise. Demand for the fuel surged as the global economy – and demand for Chinese manufactured goods – rebounded from the Covid-19 pandemic.

This rebound was compounded by drought that limited hydropower and by an inefficient electricity market, leading to power shortages in 2021. Severe droughts followed again in 2022 and 2023, along with heatwaves that pushed up demand for air conditioning.

At the same time, the global energy crisis was pushing up gas prices and ratcheting geopolitical tensions. These factors have driven a renewed push for coal in China.

Following Xi’s remarks on “strictly limit[ing]” coal, approvals for new coal-fired power plants declined by nearly 80% in the first half of 2021, compared to the same period in 2020, according to Greenpeace International.

Yet the recent push for energy security and surges in peak power demand have seen a new wave of coal plant approvals in 2022 and early 2023. This wave of approvals amounts to a “u-turn” on Xi’s coal pledge, despite conditions stating that new projects should only play “supporting” roles in the electricity system to complement variable renewables.

The power sector is the largest contributor to China’s coal demand and around 61% of its electricity was generated from the fuel in 2022, according to data from thinktank Ember.

China has made it clear that it will establish a “new power system centred on new [low-carbon] energy” in the 14th five-year plan period.

However, as Russia’s invasion in Ukraine squeezed global energy supplies, the government reiterated in 2022 that coal will remain the “ballast stone” of China’s power system.

The 14th five‐year plan for a “modern energy system”, released in March 2022, underlines the importance of energy security, even as it calls for efforts to low‐carbon transitions.

As such, China has not yet announced a clear timeline for coal phase down, let alone coal phaseout. The most recent five-year plan for the energy sector emphasises the “clean and efficient” use of coal and seeks coal plant retrofits to increase their flexibility, enabling the integration of more renewable power to the grid.

‘DUAL CARBON’ GOALS:

“Dual carbon” goals refer to China’s two climate goals announced by president Xi Jinping at the 75th session of the United Nations General Assembly in September 2020. President Xi announced that China would reach its carbon emissions peak before 2030 and become “carbon neutral” before 2060. However, it remains unclear if the latter goal refers to the neutrality of carbon dioxide (CO2) emissions or all greenhouse gas emissions. More broadly speaking, “dual carbon” goals also include China’s further climate commitments for 2030 announced by Xi at the Climate Ambition Summit in December 2020. The additional targets include a 65% drop in CO2 emissions per unit of GDP compared to the 2005 level.

Han – who leads China’s leaders group on the efforts to achieve the carbon peaking and neutrality goals, said that “clean and efficient” use of coal was “an important means” to achieve the “dual-carbon” goals during a government conference in March 2022.

More recently, in November 2023, the NDRC announced that coal power plants will receive payments from 1 January 2024 under a new coal “capacity mechanism”. (The UK and several other European countries are among those that have capacity mechanisms.)

The scheme could distort market signals that would otherwise force expensive units out of the market, analysts said, but should also increase grid flexibility and allow more wind and solar into the generation mix “without compromising grid stability or energy security”.

Another issue for China is that its fleet of coal-fired power stations is very young, averaging 12 years, and only 1.1% of its units have operated for more than three decades, which weakens the economic motive for their fast retirement.

However, if China continues to add coal capacity, it risks creating more “stranded assets”, with declining profitability and the potential to delay China’s achievement of carbon neutrality.

To date, China has not released a cap on coal capacity, coal generation or coal emissions during the 14th five-year plan or later periods.

Gas

In terms of other fossil fuels, China’s gas consumption increased fourfold between 2009 and 2022 and the share of gas in the energy mix increased from 3.3% in 2009 to 9.5% in 2022.

Although China is a major gas producer, it meets more than two-fifths of its domestic demand through imports, with Australia, Qatar, Malaysia and the US the largest suppliers.

In China, gas is considered a “clean energy” source, especially as China’s coal-to-gas policy is believed to have improved the country’s air quality. However, a recent update to China’s green finance taxonomy removed gas and “clean coal” from being eligible for green bonds.

Gas is mostly used by the industry sector for power and heat. Other major users are residential heating and the transport sector.

In heavily polluted areas, China encourages the development of gas-fired power plants or combined power and heat (CHP) plants to replace coal power plants. The last decade saw a tripling of electricity generated from gas.

According to the IEA, China accounted for nearly 30% of the total growth of gas demand in Asia Pacific during the 2020-2024 period, led by its industrial sector.

China has been importing growing amounts of fossil fuels from Russia in the wake of the global energy crisis – and Russia would like this trade to expand further through the commissioning of a second gas pipeline named “Power of Siberia 2”.

However, the IEA says China’s gas demand growth is slowing to 2% per year to 2030, down from 12% per year since 2010 “reflecting a policy preference for renewables and electrification over gas use for power and heat”.

Moreover, China’s 14th five-year plan “focuses on boosting domestic [gas] production”, the IEA says. As such, it has “considerable doubts about the viability of another large‐scale gas link with Russia” once the “Power of Siberia” link is fully up and running.

Oil

China is also the world’s fifth-largest country for oil production, accounting for 5% of the global total. Nevertheless, China overtook the US as the world’s largest oil importer in 2017.

According to the IEA, in 2020, transport accounted for 48% of oil consumption in China, followed by industry. About 25% of the oil was consumed for non-energy uses, serving as feedstock in the petrochemical industry for non-fuel products.

Unlike coal, there has not been any official announcement about the peak consumption of oil and gas. To keep up with China’s climate goals, Zhang Xiliang, a professor of management science and engineering and director of the influential Institute of Energy, Environment and Economy at Tsinghua University, suggests that China should peak oil and gas consumption by 2030 and 2035, respectively.

Prof He Jiankun, dean of the Institute of Low Carbon Economy at Tsinghua University, said in a state media interview that China should try to peak its oil consumption during the 15th FYP period (2026-2020). The increase in CO2 emissions resulting from rising gas consumption could be offset by the decrease from lower coal consumption, he said, keeping the carbon peaking goal on track.

Recent analysis from Carbon Brief shows that the rapid expansion of electric vehicles (EVs) is already having a material impact on China’s oil demand.

This illustrates why Sinopec, China’s oil-and-gas giant, recently said that the transition to EVs would cause China’s petrol demand to peak in 2023.

Still, with petrol making up a relatively small share of the total, the IEA does not expect a peak in China’s oil demand until later this decade.

Renewables

China is the world’s largest renewable energy producer and consumer. Its renewable power output nearly tripled between 2017-2022, averaging 26% annual growth during 2010-2022.

China is home to one-third of the world’s renewable energy capacity. According to the IEA, China will install almost half of new global renewable capacity in the five years 2022-2027.

The country also “dominates” global supply chains for a range of low-carbon technologies, from solar panel and wind turbine manufacturing through to refining of critical minerals.

As of the end of 2022, China’s combined total of solar and wind capacity reached 760GW, accounting for 30% of its installed electricity generating capacity overall. This percentage increases to 31%, if including installed capacity of biomass power.

Most of the growth in China’s renewable power capacity has been contributed by the fast development of solar and wind, driven by substantial government subsidies in the 2010s.

These subsidies have been phased out for solar and onshore wind (see below for more details), but remain in place for offshore wind.

From 2010-2013, China’s solar capacity grew at an annual rate of 116-204%. Between 2012 and 2022, its solar capacity grew at an annual rate of 50%. By the end of 2022, China was home to 37% of the world’s total installed solar capacity.

For wind, China had 41% of the world’s total installed capacity as of the end of 2022. Between 2012 and 2022, its wind capacity grew at an annual rate of 19.5%.

Some 92% of China’s wind capacity is located onshore, though the country overtook the UK to become the world’s largest for offshore wind in 2021.

In combination, electricity generated from solar and wind totalled 1,190TWh in 2022, accounting for 13.8% of China’s total electricity generation, shown in the figure below. Their share of electricity generation has been rising by around 2 percentage points a year.

Adding biomass, electricity generated from non-hydro renewable sources accounted for 15.4% of electricity generated in 2022, the second largest source of electricity after coal.

China’s solar resource is unevenly distributed across different regions, as the western and northern regions receive more solar radiation than eastern and central China.

However, in recent years, more solar capacity has been added in the populous eastern region. As of the end of 2021, the top five provinces with the largest installed solar capacity were all in the east, namely Shandong, Hebei, Jiangsu, Zhejiang and Anhui.

After initial development of utility-scale solar in remote areas, distributed solar, including on rooftops, has also grown in China. In 2022, around 58% of new grid-connected solar capacity came from distributed solar.

For wind, as of the end of 2021, installed capacity is mostly in the northern provinces, but more wind development has shifted to the eastern part of the country during recent years. Xinjiang, Inner Mongolia and Hebei are the top three provinces in wind power installation.

China also has cumulative biomass capacity of 41GW, as of the end of 2022. This generated 177TWh of electricity, around 2% of China’s total output.

In December 2020, Xi Jinping said that China aims to increase wind and solar capacity to at least 1,200GW by 2030. This can be compared with global total wind and solar capacity of 2,047GW at the end of 2022.

This wind and solar target for 2030 is widely expected to be met five or six years early. Recent forecasts from consultancy Rystad Energy said China’s solar capacity alone would reach 1,000GW by 2026.

Huge “clean energy bases” will make a major contribution to the target. These are combined wind and solar developments at the gigawatt scale, usually with “supporting” coal plants.

Policy changes are also part of the picture. After Xi Jinping’s announcement on establishing a “new power system with new energy at the centre”, the NDRC and NEA released a series of policies promoting the development of renewable energy, tackling challenges such as integration, transmission, tariffs and energy storage.

A few months earlier, the Central Ecological and Environmental Inspection Team (CEEIT) had criticised the NEA for “poor policy coordination” in resolving renewable “curtailment” due to periods of oversupply or insufficient grid capacity.

Curtailment – where some output is discarded because it cannot be absorbed by the electricity grid – has been a challenge for China’s solar and wind industry, particularly in the western region for solar, the northern region and part of the western region for wind. In 2016, the national solar and wind curtailment rate stood as high as 10% and 17%, respectively.

More recently, the situation has improved – albeit with ongoing issues in some regions – with national solar and wind curtailment rates having fallen to 2 and 3% in 2021, respectively.

In September 2021, China launched a pilot scheme for “green power” trading in the Beijing and Guangzhou Power Exchange, where end users of electricity can directly purchase wind and solar power from renewable power producers. This was expanded to include all types of renewable electricity generation in May 2023.

That year, 2021, was also the point when the government started to phase out feed-in tariffs nationally, for onshore wind and most solar projects. These had long been a key incentive that spurred China’s solar and wind development.

In 2021, the government allowed tariffs paid to coal plants to go up to 20% higher than the feed-in tariff benchmark to reflect the cost advantages of renewable electricity.

To increase the use – and reduce the curtailment – of renewable energy, China has also issued provincial quotas for the share of renewables in local electricity consumption.

These quotas are set to be evaluated and tightened each year. In 2023, Qinghai, Ningxia, Jilin, Heilongjiang and Inner Mongolia were given the highest non-hydro renewable consumption targets, with a range between 22% to 27.2%. The central government provides additional incentives for provinces that overperform.

China is also the world’s largest manufacturer of renewable energy equipment, including 80% of the world’s solar panels in all manufacturing stages.

Workers install solar PV modules on the roof of the Nanjing South Railway Station in Nanjing in east China's Jiangsu province. Credit: Associated Press / Alamy Stock Photo.

The rapid deployment of renewable energy in China has created “spillover” effect by bringing these low-carbon technologies down the learning curve.

This impact has been highlighted by the country’s special climate envoy Xie Zhenhua, who wrote in 2021 that China’s deployment of low-carbon technologies had “significantly” reduced their costs globally.

China’s dominance in the manufacturing and supply chains for key low-carbon technologies – at least partly thanks to government subsidies – has resulted in efforts by other countries to “derisk” or even “decouple” from Chinese production.

In addition, in October 2023, the EU launched a formal probe into China’s subsidies for EV production, after rapidly growing exports were seen as a threat to the blocs own carmakers.

This was followed by speculation over the potential launch of a further EU probe into Chinese wind turbine manufacturers.

Hydro and nuclear

In addition to ranking first in the world for the installed capacity of its coal power, wind and solar fleets, China also has more hydropower capacity than any other country.

While China’s nuclear fleet is currently the second-largest in the world after the US, it is expected to take the top spot by 2030.

For hydropower, China not only has the largest installed capacity but is also the world’s largest producer of hydroelectricity, accounting for 30% of global output in 2022.

The 1,303TWh generated in 2022 accounted for 15% of China’s electricity output that year. Around 80% of new hydropower capacity added globally in 2021 was in China.

China recently completed the 10.2GW Wudongde hydropower station in Sichuan province, the seventh-largest in the world. It also completed the 16GW Baihetan hydropower station in Sichuan-Yunnan, the second largest in the world.

The Baihetan hydroelectric Dam on the Jinsha River, Sichuan province. Credit: Imaginechina Limited / Alamy Stock Photo.

These new plants helped bring the total installed capacity of hydropower and pumped storage in China to 413GW as of the end of 2022. This is more than the combined total of Brazil, the US, Canada, India and France, respectively the countries with the world’s second, third, fourth, fifth and tenth largest installed hydro capacities in the world.

China is an active player in hydropower development around the world, backing more than half of the new hydropower plants being built in developing countries, according to the IEA.

China has pumped hydro storage capacity of 45GW, as of 2022. The NEA announced in 2021 that the country aimed to increase this capacity to 120GW by 2030.

China’s development of hydroelectricity took off in the 2000s. Over the past two decades, China added almost 300GW of hydropower capacity. Among those are the world’s largest hydroelectricity project – the 23GW Three Gorges dam – as well as the 14GW Xiluodu, 6GW Xiangjiaba and 6GW Longtan dams.

China’s hydro potential is concentrated in the southern and western part of the country, where major rivers such as the Jinsha, Lancang and Yarlung Tsangpo run off the Qinghai-Tibetan plateau – which is thousands of metres above sea level.

The massive development of giant hydropower schemes has, however, prompted concerns including seismic hazards, biodiversity loss and migration, among other issues.

In 2016, after years of environmental activism, China shelved a series of controversial giant projects on the Nu-Salween, the last undammed river in China.

In the 13th five-year plan issued in the same year, China changed its policy from “actively developing” in the previous five-year plan to “scientifically developing” hydroelectric resources.

In the most recent 14th five-year plan, it called for “scientific and orderly development” of large-scale hydropower “bases” in southwestern China, which could potentially transmit electricity to city clusters in the more populous eastern regions.

In addition to large hydropower, China also has most small-scale hydropower stations in the world. Some 53% of the world’s total small hydropower capacity is in China, according to a 2022 report by the UN Industrial Development Organization.

In China, small hydro was once promoted as a way of providing affordable low-carbon energy access in rural areas. More recently, the country started to crack down on unregulated small-scale plants citing “significant environmental impacts”.

Compared with other sources of electricity, hydropower is more prone to climate risks, such as extreme droughts and irregular precipitation.

For example, the Xiaolangdi hydroelectric station on the middle stream of the Yellow river halted power generation for three months in 2021 due to floods, whereas hydropower output was cut in other parts of the country due to drought.

Indeed, the utilisation of China’s hydro fleet recently plumbed historic lows as a result of record droughts and heatwaves in summer 2022, followed by low rainfall into 2023.

Some of China’s hydro dams also play additional roles in flood control and irrigation. The “first function” of the Three Gorges dam, for example, is flood prevention and control.

Unlike hydro, nuclear power makes up a relatively small – albeit growing – share of China’s electricity mix. The first reactor in China only came into operation in 1991 and nuclear power has expanded very quickly since then.

Indeed, the amount of electricity generated by China’s nuclear plants has increased fourfold over the past decade, from 98TWh in 2012 to 418TWh in 2022, meeting 5% of demand.

At the end of June 2023, China had an installed nuclear capacity of 57GW, as well as more than 20GW under construction. It is expected to reach at least 100GW installed by 2030.

Xudapu nuclear power plant in Huludao City of northeast China's Liaoning province. Credit: Xinhua / Alamy Stock Photo.

China has become “largely self-sufficient” in reactor design and construction. Its most-known indigenous technologies include the “third-generation” pressurised water reactor (PWR) “Hualong One”, also known as HPR1000, and the small modular reactor “Linglong One”, also known as ACP100. The 14th FYP encourages the development of small modular reactors and floating offshore nuclear power plants.

In addition, China is experimenting with a “fourth-generation” molten salt reactor, which uses thorium instead of uranium as a fuel and does not require water for cooling.

China is also scaling up nuclear heating facilities for residential heating, setting up pilots for nuclear-fueled desalination of seawater and exploring the use of nuclear to make hydrogen.

The development of nuclear power in China “stirs concerns” relating to safety and security – particularly when it comes toinland nuclear plants – according to a 2009 article in the New York Times. The lack of transparency surrounding project approval led to massive protests in a number of inland cities in the late 2000s and early 2010s, such as Anhui and Jiangxi.

Water scarcity enhanced by climate risks is another major cause of public concerns. A 2014 analysis showed that two-thirds of the planned or proposed inland nuclear plants in China were in areas with medium or extreme water scarcity.

The Fukushima incident in 2011 in Japan led to a temporary suspension of nuclear plants development in China, but the order was soon revoked in 2012. However, the construction of inland nuclear plants has been suspended since 2011 and is still debated due to safety concerns. All of China’s operating nuclear plants are in coastal areas.

China Energy News, a state-owned publication, reported in 2021 that the construction of inland nuclear power plants would continue to be paused.

A 2021 article in the Paper, a Shanghai media outlet, noted that the language around “actively carrying out preliminary work for inland nuclear power projects” in the 13th five-year plan “did not re-appear” in the 14th five-year plan. It said that this indicated a “very slim opportunity” for these inland projects to be resumed.

Nuclear energy plays a key role in the 2060 net-zero pathway prepared by Tsinghua University’s Institute of Energy, Environment and Economy (Tsinghua 3E), making up 13% of China’s total energy mix in 2060 – second to renewable energy, which would account for 68%. This would require seven-fold growth in nuclear capacity from today’s level by 2050.

China has not announced a new mid- and long-term development plan for nuclear energy since 2020. In the national nuclear development plan for 2005-2020, China failed to meet its targets of 58GW installed capacity and 30GW under construction.

With no specific target given in the 14th five-year plan outline, a new 10-year nuclear development is “in the making”, according to state-owned publication People’s Daily.

Zhang Tingke, vice chairman of China Nuclear Energy Industry Association, told the People’s Daily in 2021 that China’s nuclear capacity was expected to exceed 200GW by 2035, almost four times today’s level.

The association reportedly said in 2022 that nuclear could reach 300GW by 2035, while independent experts suggest a still-substantial 100GW by 2030 is more likely.

Industry

China’s manufacturing industry is the world’s largest, accounting for 35% of global industrial output. While its share is declining, manufacturing remains the biggest driver of economic growth in the country, making up 28% of GDP in 2022 – down from 32% in 2011.

Together with the power sector, industry is responsible for 84% of China’s CO2 emissions, according to the IEA’s most recent assessment.

Industry alone accounts for some 35% of the country’s total energy sector emissions – and 33% of the coal-generated electricity and heat go to industry.

China produces nearly 60% of the world’s steel and cement, as well as 30% of the primary chemicals used to make plastics and fertilisers, according to IEA. Its industrial assets are also very young, averaging 10-15 years.

Construction workers at a blast furnace in Jiangsu. Credit: Cynthia Lee / Alamy Stock Photo.

The Chinese government classifies steel, coal power, chemicals, nonferrous metal smelting and petrochemicals as “dual-high” industries, due to their high energy consumption and high emissions.

Local environment authorities are instructed to tighten approval, pollution control and monitoring of these projects.

According to the IEA, cement, chemicals and steel were responsible for half of the increase in China’s coal consumption during 2002-2013. As such, the steel industry is China’s second-largest emitter after electricity generation.

Investment in coal-based steelmaking is still continuing, with some analysts arguing this is at odds with the country’s 2060 carbon neutrality target.

The prominence of heavy industries explains the very high carbon intensity of China’s economy – a measure of the CO2 emissions per unit of GDP. The national average is 0.5kg CO2 per dollar in 2020, according to data from the World Bank, although there is wide variation between the most and least carbon-intensive provinces.

China’s carbon intensity was more than double the global average of 0.2kgCO2 per dollar in 2020 – and five times that of the European Union.

However, the large scale of the manufacturing industry in China is not only driven by its own development but also as a result of its export-oriented economic structure.

China is known as the “factory of the world” and a large share of its manufacturing output is bound for the international market. In 2022, 93% of China’s exports were manufactured goods, according to the World Bank data.

A substantial – but now declining – share of China’s domestic emissions footprint comes from the “embodied carbon” in goods exported for consumption overseas.

Indeed, China is the world’s largest net exporter of embodied carbon, with one 2018 study suggesting such emissions were equivalent to 20% of the country’s total.

At their peak in 2007, exports of embodied carbon made up as much as a quarter of China’s emissions. More recently, however, their share is down to around 10% of China’s total.

China has implemented a number of command-and-control policies to control the energy consumption and CO2 emissions of the dual-high industries, including capacity replacement, fuel switching, technology transformation and “clean production”.

In addition, China is also promoting market-oriented tools such as energy rights trading and emissions trading. China’s national emissions trading system (ETS), launched in 2021, initially only covers electricity generation, but a number of manufacturing industries – including steel, cement and aluminium – are expected to be added.

Some analysts suggest the specific industries due to be added to the ETS first is in response to the EU’s carbon border adjustment mechanism (CBAM), which is set to tax imports to the bloc unless they are subject to equivalent CO2 pricing.

China has opposed the EU policy, which could ultimately affect as much as $35bn of Chinese exports and is expected to increase export costs for China’s steel industry by 4-6%, according to a May 2023 analysis from Renmin University.

Since 2021, key environment and climate authorities, such as NDRC, MEE, MIIT and the CEEIT, have been instructed to “strictly contain the blind development of the dual-high industries”.

For example, the NDRC suspended more than 350 dual-high projects in the first half of 2021 and suspended the approval rights on dual-high projects of provincial governments that failed to follow the dual-energy control targets. And, in July 2023, the MEE launched seven provincial pilots on carbon impact assessments for new dual-high projects.

More recently, China has invested huge sums in the manufacturing industry for low-carbon technologies. The “new three” of solar cells, lithium-ion batteries and electric vehicles (EVs) have been taking a leading role in driving China’s economic growth and exports.

A few industrial associations, local governments – such as Shanghai – and state-owned enterprises – such as China Huadian Corporation, a state-owned utility – had proposed to peak industry emissions by 2025, which is five years ahead of China’s national deadline.

However, at the time of writing, of these three examples only Shanghai’s action plan has been made public.

Moreover, Shanghai’s public plan watered down the initial ambition to ensuring carbon peaking “before 2030”, while by 2025, energy consumption per unit of GDP will be 14% lower than in 2020, non-fossil energy will “strive” to reach 20% of total energy consumption and the city will ensure that state targets for CO2 emissions per unit of GDP are met.

Agriculture and forests

China had the world’s largest greenhouse gas emissions from agriculture during 1996-2016, according to the World Resources Institute (WRI). It has since been overtaken by India.

However, discrepancies exist across different datasets. The WRI’s data put China’s emissions at 692MtCO2e in 2014, whereas China’s latest official submission to the UN concluded that agricultural production emitted 830MtCO2e in the same year.

The submission – published in 2018 – also said that China’s land use and forestry sectors, referred to with the collective acronym LULUCF, were a net carbon sink in 2014, removing some 1,115MtCO2e.

The agricultural sector accounted for around 7% of China’s total greenhouse gas emissions in 2014, according to Carbon Brief’s analysis of the official submission to the UN.

Emissions from agriculture activities mostly consist of methane – some 22m tonnes of which were released in 2014, accounting for 40% of China’s total methane emission in that year – as well as nitrous oxide, for which releases amounted to 1.2Mt in 2014.

In 2014, ruminant animal digestion and rice paddy plantations accounted for 44% and 40% of methane emissions from agriculture, respectively. The rest came from animal waste management and agricultural waste incineration.

Agricultural land is a major source of nitrous oxide emissions in China, accounting for almost 80% of total emissions of the gas from agriculture. This land is also a carbon sink, according to the inventory, absorbing 49MtCO2 in 2014.

In 2019, agricultural activities were responsible for 1.8% of energy consumption in China, including 0.5% of coal use, 2% of petrol and 10% of diesel.

With the increase of household income and a growing middle class, the country is consuming more food, particularly meat.

China is the world’s largest producer, consumer and importer of pork. In 2020, 38% of global pork production was in China. In 2021, China’s pork consumption was estimated to be 23.7kg per capita, more than double the world’s average. That year, around 45% of the world’s pork was consumed in China.

Traditional hams being aired at a factory in Jinhua city, east China's Zhejiang province. Credit: Imaginechina / Alamy Stock Photo.

China is the world’s second-largest consumer of beef in absolute terms and its beef consumption per capita is projected to rise 8% by 2030.

The country is also the largest importer of frozen beef, poultry meat and soybean in 2021, with Brazil being the top exporter for all three products.

China became the biggest importer of agricultural commodities in 2009, according to UN trade data compiled by the thinktank Chatham House. Over the course of 2009-2019, the value of agricultural commodity imports more than doubled.

China is also one of the top exporters of agricultural products by value, accounting for 3.7% of global agricultural product trade, in terms of value, in 2020. In comparison, its imports accounted for 14% in the same year, according to the Chatham House database.

Nevertheless, when it comes to meat consumption per capita, China is 35% below the world average. An average Chinese person consumes 50% less meat than that of Vietnam, and 85% less than that of the US, according to OECD-FAO Agricultural Outlook (2021).

China sets guidelines to encourage lower meat consumption for health and nutrition reasons. The most recent “Chinese dietary guideline (2016)” published by China Nutrition Society, a national non-profit organisation supervised by China Association for Science and Technology, recommended “appropriately intake” on fish, poultry, egg and lean meat at a daily average of 120-200g, lowering the quantity from its previous versions.

This was interpreted by many international media outlets, such as the Guardian, as an act to cut 50% of the country’s meat intake due to “concerns over carbon emissions and food crises”. Such interpretations, however, received strong pushback in China.

Neither China’s official submissions to the UN nor its annual reports on national policies and actions for addressing climate change mention dietary shifts as a measure for mitigating emissions from agricultural productions.

Indeed, at the national policy level, the focus has been reducing fertiliser and agricultural chemicals, improving agricultural waste management and promoting rural biogas.

In a March 2021 speech, president Xi highlighted the potential of carbon credits in the ecological systems, calling to “give full play” on the role of carbon sequestration of the forest, grassland, wetlands, ocean, soil and permafrost.

Draft legislation on China’s voluntary emissions reductions market, known as the China Certified Emission Reductions (CCERs) scheme, was released in July 2023.

Credits will be issued for projects including forestry, with the scheme expected to relaunch imminently at the time of writing.

The 14th five-year plan on forest and grassland management, released in August 2021, set two targets on increasing forest coverage to 24.1% and forest stock to 19bn cubic metres.

Transport

In contrast to the situation in most developed economies, the transport sector makes up a relatively small share of China’s greenhouse gas emissions.

The Innovation Center for Energy and Transportation (iCET), a Beijing-based thinktank, estimates that transport contributed about 10% of China’s greenhouse gas emissions in 2019. In comparison, 29% of the US total GHG emission came from transport in 2021.

However, GHG emissions from transport have grown fast in China during recent years, maintaining an average annual growth rate of 5% between 2012-2021, according to the MEE. In 2018, China accounted for 11% of global greenhouse gas emissions from transport, according to the World Resources Institute – just behind the US and the EU plus UK.

According to China’s most up-to-date official GHG Inventory, the transport sector emitted 820MtCO2e of greenhouse gases in 2014. In particular, road transportation contributed 84% of total greenhouse gases emissions of the transport sector.

By 2022, China had 417m registered motor vehicles, growing from 5.5m in 1990.

In July 2021, China Science Daily, a state-affiliated media outlet, cited an official from the MEE saying that the transport sector’s CO2 emissions would peak around 2028-2030.

Already by mid-2023, however, EV adoption was for the first time substantially curbing petrol demand growth, according to analysis for Carbon Brief. Sinopec, China’s oil-and-gas giant, recently said that the transition to EVs would cause China’s petrol demand to peak in 2023.

The planning for a lower-carbon transport sector started about a decade ago, including an eight-year development plan issued in 2012 by the State Council.

This was designed to promote the “new energy vehicle” (NEV) industry, a term that includes battery-electric, plug-in hybrid and fuel cell vehicles. The plan focused on energy saving, pollution control, reducing fuel consumption and industry upgrades and transformation.

While NEVs reduce emissions and air pollution, some analysts argue that larger motivating factors were energy security – via reduced oil imports – and industrial competitiveness.

In 2014, China outlined a few emissions reduction targets for the transport sector in the national plan for tackling climate change (2014-2020).

In the first NDC submitted in 2015, China pledged that public transportation would account for 30% of motorised travel in medium- and large-sized cities by 2020, to promote the development of a “dedicated transport system” for pedestrians and bicycles, and to accelerate the development of “smart transportation” and “green freight” transport.

In November 2020, the State Council issued a second long-term plan for NEVs.

According to the International Council on Clean Transportation (ICCT), its aims were to form a “globally competitive auto industry with advanced NEV technologies and good brand reputation”; to shift to an energy efficient and low-carbon society with convenient charging networks and EVs as the “mainstream” choice in car sales; and to improve national energy security, air quality, greenhouse gas emissions and economic growth.

The plan set a target for 20% of new car sales to be NEVs by 2025 – a target already beaten as of 2022 – and for EVs to be mainstream, making up the majority of sales by 2035.

The plan also committed to 100% electrification of public sector vehicle fleets, expanding and improving public charging networks, and commercialising hydrogen fuel cell vehicles.

According to a 2021 article from the state-owned People’s Daily, China had by then already been the world’s largest producer and consumer of new energy vehicles for “six years in a row”, accounting for more than half of global sales.

By 2022, China accounted for nearly 60% of the world’s electric car sales, according to the IEA, which expects the country to retain 40% of the market even in 2030.

Domestically, there were some 13m NEVs on China’s road in 2022, making up 4% of all registered vehicles, according to official government figures. (The IEA puts the total at closer to 14m.)

According to IEA, 29% of China’s domestic car sales were electric cars in 2022, up from 16% in 2021 and below 6% between 2018 and 2020. The agency says that, as of 2023, EVs “cost less…on average” in China than equivalent combustion-engine cars.

Electric vehicles at Chinese automaker Chery Holding Group Co., Ltd., Wuhu City, Anhui Province. Credit: Sipa US / Alamy Stock Photo.

The country is set to export more cars than it imports, for the first time in 2023, thanks to the growth of NEV manufacturing and sales.

China also produces around three-quarters of the world’s lithium-ion batteries and owns 70% and 85%, respectively, of global production capacity for the key battery components cathodes and anodes, according to a 2021 IEA report.

China has also made progress in electrifying the country’s railway system. According to China’s National Railway Administration, the share of internal combustion engines in the railway system has decreased from 51% in 2012 to 36% in 2021, and the electrification rate of China’s railways has increased from 52% in 2012 to 73% in 2021.

The 14th five-year plan outline released in March 2021 further confirmed that China plans to accelerate railway electrification between 2021 and 2025.

Another key policy to decarbonise the transport system is to promote high-speed railways as a low-carbon alternative to air and road traffic, especially for short-distance travel. China already had by far the largest high-speed rail network in the world, as of 2017.

According to China National Railway Group, the energy intensity of high-speed trains is only 18% and 50% that of aeroplanes and passenger buses, respectively. The CO2 emissions are even lower: only 6% and 11% that of aeroplanes and passenger buses, respectively.

The 14th five-year plan outlined national key projects of building 3,000km of new railway transport in urban clusters, 25,000km of new construction and upgrades of highways, and more than 30 new civil airports.

Carbon Brief analysis has also shown that railway investment was the “single-largest” category in post-Covid stimulus plans of the eight top-emitting Chinese provinces, accounting for 36% of energy-related spending. Road-building was the third largest, at over 10% of the total.

While railway expansion continues, there have been concerns that its spread into the less populated western and northern parts of China will reduce average occupancy and increase the fiscal burden on already indebted local authorities, due to railway investments.

Data from the ministry of transport shows that both the number of passengers carried and the total number of passenger-kilometres travelled by rail was on a rising trend between 2015 to 2019, but dropped since 2019.

Despite the growth of high-speed rail, China’s domestic air travel has also been expanding very rapidly, with one pre-Covid study suggesting CO2 emissions from the sector could quadruple by 2050.

The Beijing-Tianjin Intercity Railway in north China's Tianjin. Credit: Xinhua / Alamy Stock Photo.

In October 2023, Reuters reported that China’s aviation regulator had increased the number of domestic flights to 34% above pre-pandemic levels.

Analysis from aircraft manufacturer Boeing published in September 2023 and covered by China Daily said the country’s domestic aviation market would “surpass those in North America and Europe to become the world’s largest by 2042”.

Impacts and adaptation

China is one of the countries that is most affected by the adverse impacts of climate change, according to its third national communication submitted to the UNFCCC in 2018.

According to the Chinese government’s “blue book” – a standard reference document – on climate change in 2022, the country has been warming by an average of 0.26C per decade since 1951. In 2022, surface temperatures in China were 0.92C above average and among the three warmest years since the beginning of the 20th century.

The country is also experiencing growing risks from sea level rise. Between 1980 and 2021, sea levels around China’s coasts had risen by 3.4mm per year, above the global average during the same period. By 2021, sea levels were 84mm above the 1993-2011 average.

Currently, more than 650 million people reside in China’s coastal provinces, more than 150 million of which are in low-elevation areas. An increase of just 1cm could see the coastline receding by more than 10 metres in parts of China, according to 2019 research.

China faces high exposure to flooding, tropical cyclones and their associated hazards. The country also faces significant risks from droughts.

In the “Inform Risk Index” 2023 led by the European Commission’s Joint Research Center, China ranked 87 out of 191 countries and regions.

Flooding, extreme heatwaves and other natural hazards have resulted in heavy human and financial costs. According to the ministry of emergency management, flooding has impacted 33.85 million people and caused a direct economic loss of 128.9 billion CNY ($17.86bn) in the year of 2022 alone.

Nan'an District in southwest China's Chongqing was hit by severe flooding in 2020. Credit: Sipa US / Alamy Stock Photo.

Mckinsey, a management consulting company, estimates that, since 1990, floods have resulted in $1tn of economic losses in the country and, over the course of 2008-2018, China lost 9m hectares of arable land per year and a total of 760 lives. A 2018 study’s projection shows that China will bear the largest flood cost in the world in 2100.

Mckinsey’s projection has also shown that extreme heatwaves and humidity have reduced the average work hours by 4% in China, which is associated with 1.5% GDP loss. As the work hour loss increases to 6.5% in 2030 and 9% in 2050, the GDP loss associated with it will double to 2-3% in 2050, the company says.

Rising temperatures will continue in the coming years. According to Carbon Brief’s analysis, China is projected to warm by between 1.9-6.6C by 2100, depending on the level of emissions over the rest of this century.

China’s own projection is slightly lower, as it estimated an average temperature change of 0.08C, 0.26C and 0.61C every 10 years between 2011 and 2100 in low, moderate and high emissions scenarios. This corresponds to an additional 0.72C-5.45C of warming by 2100.

Extreme weather events increase risks to food security. Due to climate change, more than half of arable land in food-producing regions has at least one crop showing a declining trend in yields, according to China’s third national communication. The land area experiencing yield decreases accounts for 18.7% of China’s total arable land, the document says.

The document also shows that rising temperature will increase the occurrence and area of impact for most crop diseases and pests in China.

Another major climate impact is on the water system. The national communication concludes that climate change contributes to 40% of the decrease in the run-off of the Yellow River.

It adds that some 82% of glaciers in China, especially in the mountainous areas on the edge of the Tibetan Plateau, are in a state of retreat or disappearance. Moreover, it finds that the retreat of some glaciers, including the Chomolungma Glacier in Mount Everest, has significantly accelerated since 1997.

Climate change has also caused wetland degradation, the document says, as well as loss of biodiversity and the reduction of forests’ function in China.

China has not officially submitted its national adaptation plan to the UNFCCC, but it outlined the country’s major adaptation measures in the latest national communications.

In 2013, China released a seven-year national adaptation strategy for climate change, which pointed out that China lacked a regulatory and legal system for adaptation, was short of climate resilient infrastructure, needed to enhance climate adaptation capabilities in vulnerable regions and needed to strengthen ecological protection.

A year later, the government released another six-year national plan for tracking climate change. At the ministry level, the state forestry administration, and the NDRC with the ministry of housing and urban-rural development (MOHURD) released action plans for climate adaptation in forestry and cities, respectively.

These policies provide general guidelines for provincial and city governments to increase capacity for climate adaptation and address water resource management and infrastructure construction, agriculture and forestry, ocean and coastal zones, ecologically fragile areas, population health, and disaster prevention and mitigation as key intervention areas.

In May 2022, China released the 2035 national adaptation strategy on climate change. Compared to the 2013 plan, the number of ministries participating in drafting the plan increased from nine to 17. The updated plan also gives more emphasis to proactive adaptation, instead of passively responding to climate impacts.

The new adaptation plan calls for the establishment of an early warning system for climate change risks and to improve its accuracy and precision to “advanced international level” by 2035. The plan also asks for a reduction of water intensity – the amount used per unit of economic growth – by 16% by 2025 compared to the 2020 level.

Notes

Graphic by Joe Goodman and Tom Prater for Carbon Brief.

The figures in this article are drawn from a range of Chinese government and international sources and relate to the Chinese mainland only.

Data for energy consumption comes from Energy Institute Statistical Review of World Energy 2023. Unlike earlier country profile infographics, exajoules (EJ) have been used instead of millions of tonnes of oil equivalent (Mtoe) as the unit of energy consumption.